Economics: Difference between revisions

Julia.Detar (talk | contribs) |

Julia.Detar (talk | contribs) |

||

| Line 5,442: | Line 5,442: | ||

The above procedure results in a trade flows matrix where all row-sums are equal to XS. To ensure that the column-sum of this flows matrix is equal to MS, we enter into an balancing process that iteratively adjusts row and column values until their sums are equal to (within a small tolerance) XS and MS.<ref>While this process ensures consistency between the dyadic and monadic trade models, it potentially introduce some issues. First, it explicitly privileges monadic estimates (based largely from World Bank balance of payments statistics) over Comtrade-based estimates. Second, it runs the risk of inflating trade values between well documented partners. Third, it may initialize trade between partners where there are in fact zero-flows.</ref> | The above procedure results in a trade flows matrix where all row-sums are equal to XS. To ensure that the column-sum of this flows matrix is equal to MS, we enter into an balancing process that iteratively adjusts row and column values until their sums are equal to (within a small tolerance) XS and MS.<ref>While this process ensures consistency between the dyadic and monadic trade models, it potentially introduce some issues. First, it explicitly privileges monadic estimates (based largely from World Bank balance of payments statistics) over Comtrade-based estimates. Second, it runs the risk of inflating trade values between well documented partners. Third, it may initialize trade between partners where there are in fact zero-flows.</ref> | ||

==== 12.13. | ==== 12.13.4 Dyadic displays ==== | ||

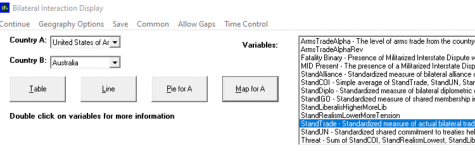

The IFs system facilitates analysis of dyadic/bilateral data and forecasts with two displays. Because dyadic analysis within IFs began with analysis of historical data, both displays are found under the Data Analysis main menu option rather than under the Display option in spite of the fact that the second of them allows analysis of both data and forecasts. These are named Bilateral Interaction Display and Bilateral Interaction Display with Gravity Option. The first is available regardless of whether the bilateral switch '''''bilateralsw''''' parameter is activated and the bilateral base case has been created, but the second is only available when that parameter has been set to 1.0 in a model run. The text of economic model documentation on Bilateral Elaboration of Trade and Other Interstate Flows explains the general process of setting up bilateral elaborations of the IFs economic model. Here we discuss the two displays in turn. | The IFs system facilitates analysis of dyadic/bilateral data and forecasts with two displays. Because dyadic analysis within IFs began with analysis of historical data, both displays are found under the Data Analysis main menu option rather than under the Display option in spite of the fact that the second of them allows analysis of both data and forecasts. These are named Bilateral Interaction Display and Bilateral Interaction Display with Gravity Option. The first is available regardless of whether the bilateral switch '''''bilateralsw''''' parameter is activated and the bilateral base case has been created, but the second is only available when that parameter has been set to 1.0 in a model run. The text of economic model documentation on Bilateral Elaboration of Trade and Other Interstate Flows explains the general process of setting up bilateral elaborations of the IFs economic model. Here we discuss the two displays in turn. | ||

===== 12.13. | ===== 12.13.4.1 Bilateral interaction display ===== | ||

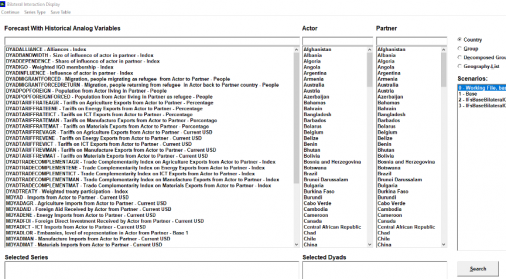

The Bilateral Interaction Display of IFs (under the Data Analysis option in the Main Menu) currently displays historical dyadic data for 13 series (using series from IFs.mdb/GovConflictDataDict and GovConflict files). The display could be expanded to include additional series, but has several limitations, including with respect to: (1) selecting multiple dyad-pairs in either the line or table displays, (2) selecting multiple actors or multiple partners with any of the displays, and (3) drawing cross-sectional graphs. This is in many respects a legacy display form and almost all users will prefer using the form for Bilateral Interaction Display with Gravity Option. | The Bilateral Interaction Display of IFs (under the Data Analysis option in the Main Menu) currently displays historical dyadic data for 13 series (using series from IFs.mdb/GovConflictDataDict and GovConflict files). The display could be expanded to include additional series, but has several limitations, including with respect to: (1) selecting multiple dyad-pairs in either the line or table displays, (2) selecting multiple actors or multiple partners with any of the displays, and (3) drawing cross-sectional graphs. This is in many respects a legacy display form and almost all users will prefer using the form for Bilateral Interaction Display with Gravity Option. | ||

[[File:ED Section 12.13.3.1 Ifs Screenshot.png|none|thumb|475x475px]] | [[File:ED Section 12.13.3.1 Ifs Screenshot.png|none|thumb|475x475px]] | ||

===== 12.13. | ===== 12.13.4.2 Bilateral interaction display with gravity option ===== | ||

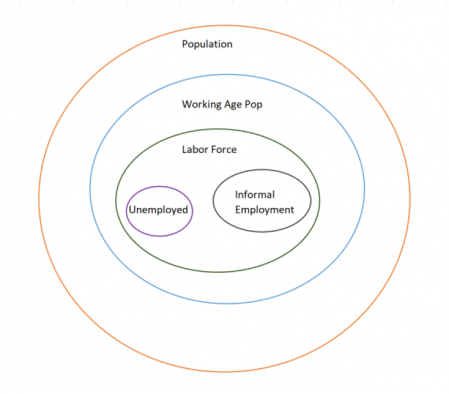

The form for Bilateral Interaction Display with Gravity Option is also under the Data Analysis option in the Main Menu. It is available only when the bilateral data files have been added to an install version of IFs, the '''''bilateralsw''''' parameter has activated, and the Base Case of the model has been rebuilt and run. Moreover, the form is password protected and requires supply of this password: dyad4IFs12. The form facilitates analysis of both historical data and forecasts. | The form for Bilateral Interaction Display with Gravity Option is also under the Data Analysis option in the Main Menu. It is available only when the bilateral data files have been added to an install version of IFs, the '''''bilateralsw''''' parameter has activated, and the Base Case of the model has been rebuilt and run. Moreover, the form is password protected and requires supply of this password: dyad4IFs12. The form facilitates analysis of both historical data and forecasts. | ||

[[File:ED Section 12.13.3.2 Ifs Screenshot.png|none|thumb|506x506px]] | [[File:ED Section 12.13.3.2 Ifs Screenshot.png|none|thumb|506x506px]] | ||

Revision as of 21:39, 27 July 2023

1 Introduction: Foundations

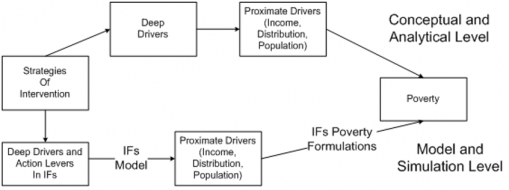

This section provides a brief introduction to the full IFs forecasting system before turning to an identification of three major and in combination unique features of IFs economic model: its production function, social accounting matrix, and equilibration dynamics. Subsequent sections will elaborate those elements of the economic model before documenting some additional aspects of that model, including its bilateral elaboration of trade and other international flows, its labor market, and its representation of the informal economy. Two additional sections address its representations of inequality and poverty. Supplemental appendices provide additional information about data foundations and present some block diagrams of the model.

1.1 The Broader IFS Context of the Economic Model

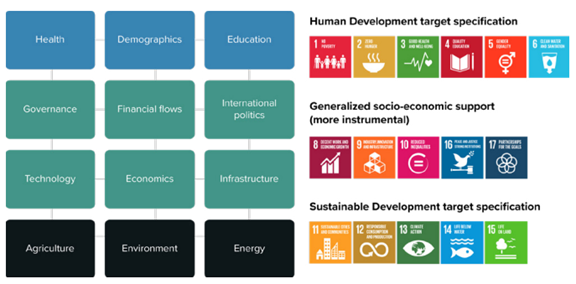

Since well before the promulgation of Sustainable Development Goals (SDGs), the philosophy underlying the IFs project has been that multiple global issues benefit greatly from integrated analysis and action. Such issues, as in the SDGs, cut across the general categories of (1) human development (demography, health, education, and basic income levels), (2) social organization and development (socio-political stability, equity and governance with economic advance), and (3) sustainable development (protection of the environment against climate change and other damage). Figure 1.1 roughly maps the models of the IFs system to the SDGs organized in the three issue sets. IFs includes multiple hard-linked models, including demographic, education, health, economic, infrastructure, governance, international politics, agriculture, energy, and environment sub-systems. Across its integrated components IFs can generate alternative scenario forecasts for 188 countries through 2100, including the Base Case scenario.

International Futures (IFs) falls generally into the categories of “world models” (Hughes 1985) and “integrated assessment models (IAMs)”. Its uniqueness lies partly in the extent of its issue coverage, allowing a large range of basic research opportunities and applied policy analysis. The software system has an easy-to-use interface. Also it is publicly and freely available on-line (at https://www.ifs.du.edu/ifs/frm_MainMenu.aspx). See also information on the Pardee Center at https://korbel.du.edu/pardee

Across time there have been numerous descriptions of the entire IFs system (Hughes 1999, 2001, 2016, and 2019: Hughes and Hillebrand 2006). Those, especially Hughes (2019), put it in the context of other world models and integrated assessment models. Briefly surveying in this subsection the models of IFs and some of their interconnections with each other and the economic model sets the stage for more extended explanation of the economic model. Because variables in the other models drive and/or are driven by the economic model, understanding those connections helps understand it.

Figure 1.1 The models of the International Futures (IFs) system and related SDGs. Source: Hughes, Hanna, et al. (2021).

The human development models facilitate the use of IFs in long-term economic forecasting. For instance, consistent with single-year time steps in the economy’s recursive structure, the structure of the demographic model is cohort-component and sex-specific with single-year cohorts that advance over time as the economic model does. The health model provides mortality calculations in 15 subcategories across communicable, non-communicable and injuries categories (Hughes, Kuhn, Peterson, Rothman and Solórzano 2011; Hughes, Kuhn, Peterson, Rothman, Solórzano, and Mathers 2011; Hughes et al., 2015; Kuhn, et al. 2016), using data from the Global Burden of Disease project. Fertility calculations draw upon infant mortality from the health model and on years of adult educational attainment from the education model (Dickson, Hughes, and Irfan 2010). The demographic model also forecasts migration patterns (Cantore and Cali 2015), which affect remittances in the economic model.

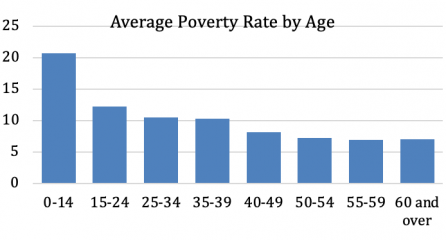

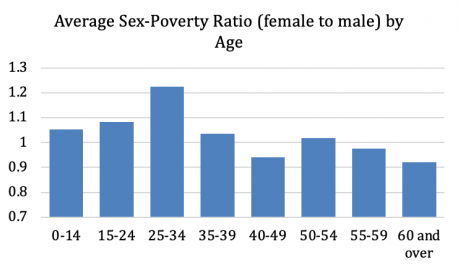

The education model also has cohort-component and sex-specific representation. Single-year cohorts of individuals progress through primary, lower secondary, upper secondary, and tertiary education. Very important to the economic model, they also carry years of formal education through adult years of working life. Together, the demographic model provides potential labor supply numbers to the economic model, while the health and education models provide variables that help determine economic productivity. Together with the demographic, health, and education models, the economic model and its attention to national and global income distribution (Hillebrand 2008) have been used to study prospects for reducing poverty and making progress toward other SDGs (Hughes and Irfan 2007; Hughes, et al. 2008; Milante, Hughes and Burt 2016; Moyer and Bohl, 2019; Hughes et al. 2020; Moyer and Hedden 2020; and Moyer et al. 2022).

The partial equilibrium agriculture model represents crop, meat, and fish categories. The energy model (Hughes 1986) has six categories of renewable and nonrenewable energy. Those two models are tightly integrated with the general equilibrium economic model, providing information on supply and demand for the first two of its six economic sectors. In turn, the general model provides investment allocations to the agriculture and energy models. In addition, the partial equilibrium models have a large role in calculations of variables within the environmental model that affect economic growth, including atmospheric carbon level (Hughes et al., 2011; Birkman et al 2012.

The socio-economic models are closely interlinked with each other and with models at the human development and sustainability levels of Figure 1.1. Governance, including levels of stability and instability (Hughes, et al., 2014; Joshi, Hughes, and Sisk 2015; Bowlsby et al. 2019) affects economic growth. Government finance affects health and education variables that also affect economic growth. That finance also has a key role within infrastructure (Rothman et al., 2013), the model for which represents the changing stock of transportation, electricity, water and sanitation, and information/communication technology infrastructures. That infrastructure again affects economic productivity. International relations help shape international flows of foreign assistance and remittances; in interaction with trade (Hillebrand 2010) they shape current account and international debt/asset balances, important economic variables. Future economic growth and broad global transitions (Hughes 1997; Gordon et al. 2011) depend also on technological advance; IFs has increasingly developed technology representatons (Hughes and Johnston 2005; Moyer and Hughes 2012; Hughes et al. 2017; Scott et al. 2022).

Long-term economic growth models differ on many dimensions. While some models rely primarily on statistical estimation of growth patterns from historical data, others build somewhat more heavily on elaborated representation of structural drivers of growth. For instance, the Bayesian latent factor model used by Muller Stock, and Watson (2022) is highly statistical; it was fitted to global GDP per capita data back to 1900. In contrast, and somewhat more like IFs, the economic models that have been used to generate the economic forecasts for the five Shared Socioeconomic Pathways have had more structural representation. For instance, they include production functions representing variables such as educational attainment and trade openness; see Crespo Cuaresma (2017) and Dellink Chateau, Lanzi and Magné (2017).

This sketch of the broader IFs system has laid foundations for focused elaboration of the economic model, beginning with a general survey of it.

1.2 The Economic Model

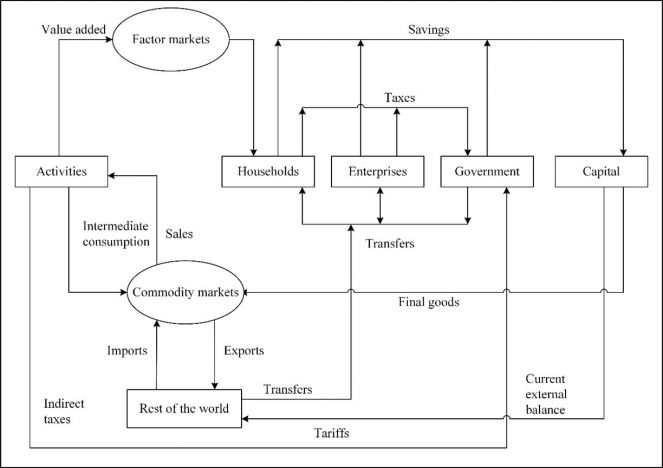

The International Futures (IFs) system’s economic representation is a global, annually recursive dynamic general equilibrium model, integrated extensively with all other models of IFs.

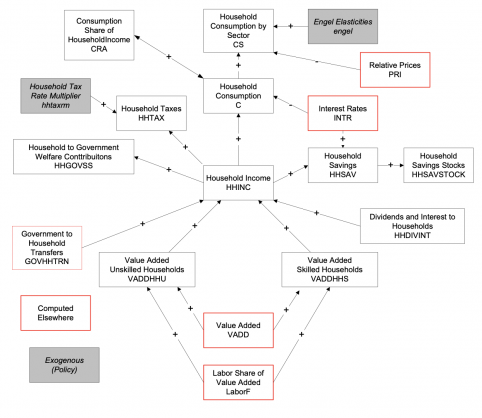

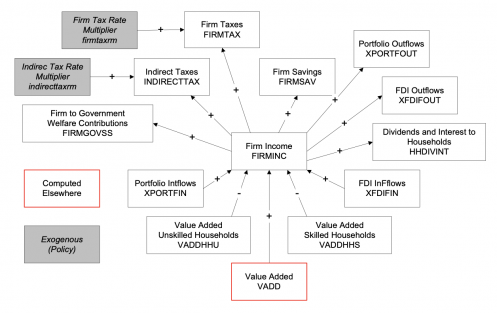

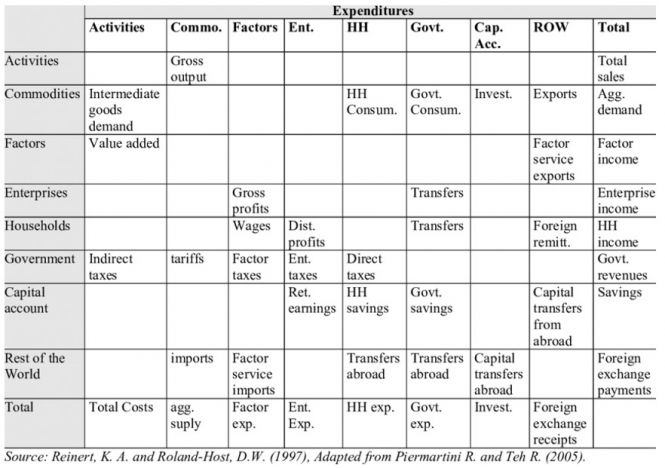

It draws on two general economic modeling traditions.[1] The first is the dynamic growth model of classical economics. In that tradition production functions play a central role. Consistent with that, within IFs the growth rates of labor force, capital stock, and multifactor productivity largely determine the overall magnitude of production and therefore of the economy. The second tradition is the general equilibrium model of neo-classical economics. The modeling of general equilibrium often involves a representation of social accounting matrices (SAMs). SAM-based models typically represent alternative equilibrium states for financial flows among actor categories via either comparative static analyses or as change across time in response to selected drivers. IFs contains a six-sector (agriculture, raw materials, energy, manufactures, services, and ICT) equilibrium-seeking representation of domestic supply, domestic demand, and trade. The goods and services market representation is embedded in a larger social accounting matrix structure that introduces the behavior of household, firm, and government agent classes and the financial flows they determine.

Three significant features differentiate IFs from most other models with these characteristics (Hughes 2019). First, the representation in IFs of economic growth is responsive to an unusually extensive set of productivity drivers, as well as to capital and labor. It is quite common in production functions to endogenize response of labor productivity or total factor productivity to education, R&D expenditures, and trade openness. Typically, modifiers of conditional convergence processes across countries represent such responsiveness (e.g. Crespo Cuaresma 2017; Dellink et al. 2017). IFs adds to these variables multiple other drivers including health, governance quality, infrastructure, and climate change (Hughes and Narayan 2021). This feature facilitates representing positive feedback loops or synergies across the broader IFs model system; for instance, expenditures on water and sanitation infrastructure can increase economic growth and, in turn, enhance capacity for additional investments in watsan or elsewhere.

Second, the social accounting system of IFs has an especially extensive representation of government revenues and expenditures. One reason for this is that expenditures on education, health, and infrastructure (in addition to those on the military and R&D) hard link the IFs economic model to other large-scale IFs models in those issue areas. Because many policy analyses involve such expenditures, their representation facilitates tying developmental advance to spending, including also accounting for trade-offs and negative feedbacks. In support of initializing multiple streams of government revenue and expenditures (including transfer payments), IFs draws heavily on data from the International Monetary Fund, the World Bank, and the OECD. Hughes, et al. (2020) describe the complexity of the “nowcasting” within IFs that assures internal consistency of monetary and other data in the system’s base year, a capability that uses an integrated data preprocessor that can quickly process data updates across all models in IFs. Social accounting in IFs also has an extensive representation of international flows, augmenting trade with foreign aid and migration with associated remittances.

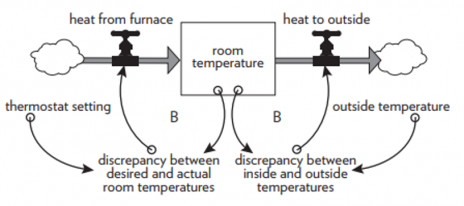

A third unusual feature of IFs is its representation of economies as chasing equilibrium across time rather than achieving it each year―while maintaining accounting consistency. Hence, for instance, IFs uses annual rise and fall in inventory stocks to generate price signals to the supply and demand sides of markets (domestically and internationally), and it uses net government debt and asset stocks to provide signals for changes in expenditures and revenues across time. Whereas SAMs focus on annual flows, this approach more generally underlays that flow matrix in IFs with a second and supportive matrix representation of financial stocks. This representation avoids the necessity of specifying closure rules in each time step for the equilibrations and facilitations scenario analysis with interventions on both demand and supply sides of agent behavior.

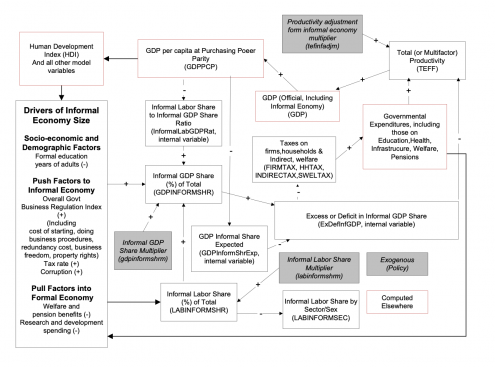

Several additional features are important within and because of the broader IFs system linking the economic model to other models within IFs. For instance, separate partial equilibrium models of agriculture and energy in physical terms produce values of production and trade that, when converted to currency, override the respective computations in the multi-sector economic model, while the accounting across sectors in that model provides realistic tradeoffs that constrain investment and shape the availability of it in the physical models. Also, a representation of the size of the informal economy across time allows calculation of its changing impacts on productivity and government revenues. Further, feedback of global warming to GDP and productivity builds on the approaches of Nordhaus and Moffat (2017) and Dietz and Stern (2015).

The structure of IFs also recognizes that short-term dynamics of economic growth differ from long-term dynamics. For instance, COVID-19 has disrupted economic growth and there is still uncertainty concerning (1) the degree to which the disruption is a relatively short-term fall in capacity utilization that will rebound post-pandemic and (2) how much of the growth loss represents factors such as reduced investment or obsolescence of capital stock and changing labor participation that will persist long after its end. Parameterization in IFs facilitates alternative scenarios.

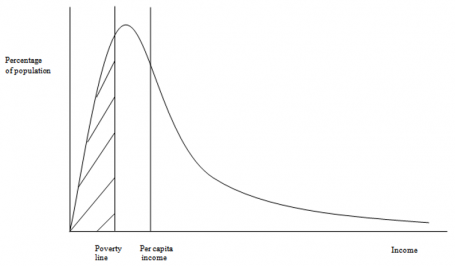

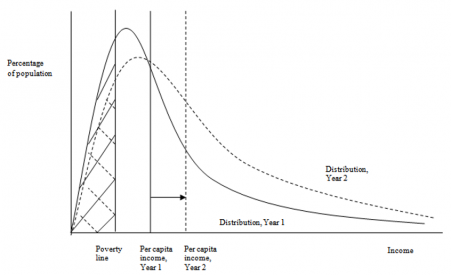

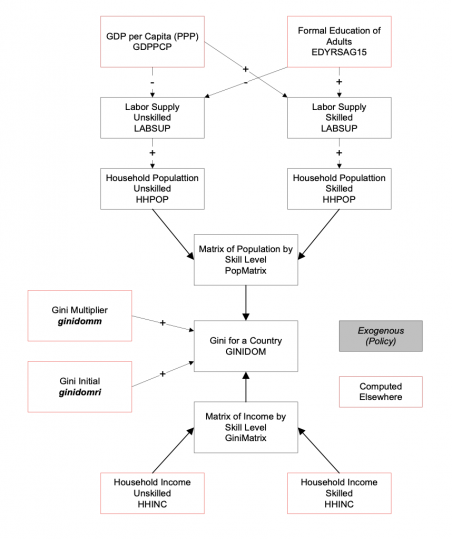

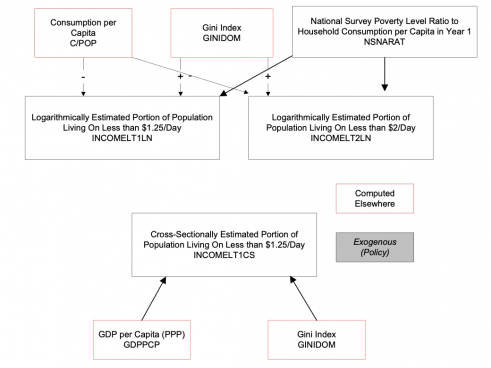

Also very important for the analysis done with the IFs system, including across the Sustainable Development Goals, the representation of household consumption in the SAM, in combination with the IFs educational model’s projections of the skill levels of those households, facilitates endogenized computation of changing income distributions. Average consumption and distribution provide the proximate foundations for forecasting of poverty in IFs, while the broader model represents their distal drivers. In general, the structures and usage of IFs have devoted a great deal of attention to such representations of human development, as well as to socioeconomic change and sustainability. Representation of both the labor market and the informal economy also support that attention.

Further, the inclusion with the IFs system of a “data preprocessor” supports continuous updating of a very large data base and automated recalculation of initial conditions and many parameters. The system’s user-friendly interface and open-source status have long contributed to widespread use, feedback, and enhancement. This documentation of the economic model “nexus” of IFs ranges across all these features of the system.

[1] Fardoust and Dhareshwar (2013) provide a useful review of past long-term economic forecasting efforts particularly within the World Bank, their successes and failures, and factors to consider in efforts going forward.

2 Goods and Services Market Supply Side and Economic Growth

Before turning to economic demand and financial flows within the social accounting matrix (SAM) and then moving to explanation of intertemporal dynamics, this section treats the supply side of the economic model.

2.1 Introduction

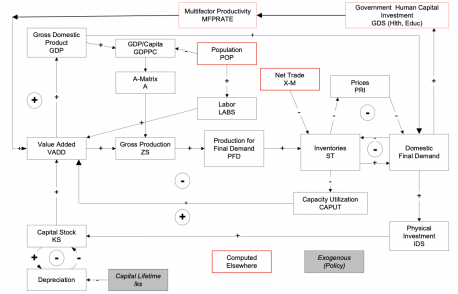

The goods and services market sits within the larger social accounting matrix that tracks financial flows among households, firms, and the government and that shapes the demand side of the market. The economic growth portion of the goods and services module responds to endogenous labor supply growth (from the demographic model with attention to participation rates, especially of women), endogenous capital stock growth (with a variety of investment level influences), and a mixture of endogenous and exogenous specification of advance in drivers of multifactor or total factor productivity (terms used interchangeably here). The productivity formulation represents a combination of generalized convergence and country-specific elements that together create a conditional convergence formulation.

Two "physical" or "commodity" models in IFs, agriculture and energy, have structures very similar to each other and to the economic model. Their partial equilibrium structures optionally, and by default in the Base Case and almost all other scenarios, drive supply and demand calculations of those sectors within the goods and services market module.

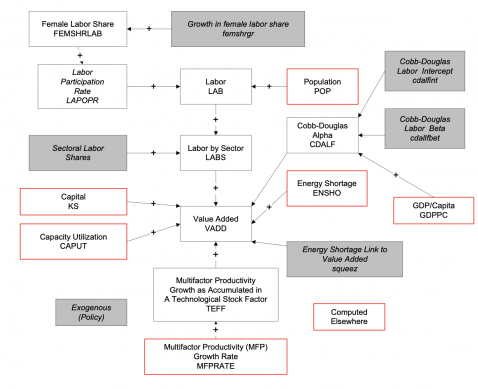

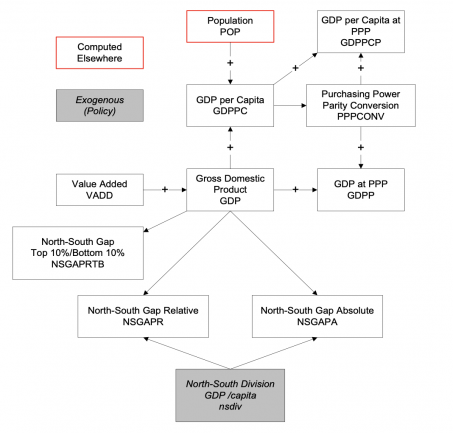

2.2 The Production Function: Overview

The core Cobb-Douglas equation for the production function computes value added (VADD) in each economic sector from sector-specific values of total factor (or multifactor) productivity (TEFF), capital (KS), labor (LABS), and capacity utilization (CAPUT), initially set exogenously (caputtar) and changed over time dynamically in response to inventory stock levels (see Section 4). A time-constant scaling factor (CDA) assures that value added is consistent with data the first year. The function requires sectoral exponents for capital (AlphaS) and labor that, assuming constant returns to scale, sum to one within sectors. Within IFs, gross domestic product (GDP) is the sum across sectors of valued added. Although the production function for VADD can serve all sectors of IFs, the parameters agon and enon act as switches. When their values are one, which is the default, production in the agricultural and primary energy sectors, respectively, are determined in the larger, partial equilibrium models and the values then override the computation of gross sectoral production (ZS). See this documentation (Section 3.3.1.2 within the SAM description) for explanation of how gross production from those models is used in association with intersectoral flows to compute value added for those sectors.

2.2.1 IFs Documentation Notation

IFs variable names accessible in the interface appear in upper case italics, while parameter names appear in bolded and italicized lower case. Variable names that appear in mixed case reflect other calculations local to the model code. The local variable names shown in documentation equations may differ somewhat from those in the code for clarity of presentation.

Subscripts:

- r is country/region (regions can be groups of countries or subregions within them)

- c is age category/cohort

- d is cause of death

- e is energy type

- f is food type

- g is government spending sector

- h is household type by skill level

- i is infrastructure category

- l is land category

- p is sex

- s is economic sector

- sk is skill level of labor

- wd is water demand sector

- ws is water supply sector

- t is time, and will not generally be shown unless the equation involves more than one time-step, e.g. with a lag from the preceding year (t-1), or referring to initial conditions (t=1)

2.3 The Production Function Continued

A later subsection of this documentation explains the drivers of investment and capital formation (net of depreciation). Investment is endogenously computed as part of the social accounting matrix structure and within the model’s equilibration system. A subsequent section elaborates the labor model of IFs with its attention to demographic structure and age-sex work-force participation rates.

The focus here will be on the multifactor (total factor) productivity term. That term is especially important in IFs because it is responsive to the dynamics of most of the other models in IFs, including those representing education, health, infrastructure, and governance. Solow (1956) long ago recognized that the standard Cobb-Douglas production function with a constant scaling coefficient in front of the capital and labor terms was inadequate because the expansion of capital stock and labor supply leave a large portion of economic growth unexplained. It then became standard practice to represent an exogenously specified growth of technology term in front of the capital and labor terms as "disembodied" technological progress (Allen 1968: Chapter 13). Romer (1994) began to show the value of unpacking such a term and specifying its elements in the model, thereby endogenously representing this otherwise very large residual, which we can understand to represent the growth of multifactor productivity (MFP).

In IFs that total endogenous productivity growth factor (TEFF) is the accumulation over time (hence a stock like labor and capital) of annual values of growth in multifactor productivity (MFPGROWTH).

There are many components contributing to growth of productivity, and there is a vast literature around them. See, for example, Barro and Sala-i-Martin (1999) for theoretical and empirical treatment of productivity drivers; also see Barro (1997) for empirical analysis (or McMahon 1999) for a focus on education

In the development of IFs there was a fundamental philosophic choice to make. One option was to keep the multi-factor productivity function very simple, perhaps to restrict it to one or two key drivers, and to estimate the function as carefully as possible. Suggestions from other modeling efforts include focusing on the advance of education, the extent of global connections of a national economy, the availability/price of energy, and the growth in electronic networking and the knowledge society.

The second option was to develop a function that included many more factors known or strongly suspected to influence productivity and to produce a more integrated representation of the function, using empirical research by others and within the project to aid the effort as much as possible. The advantages of the second approach include creating a model that is much more responsive to a wide range of policy levers over the long term. The disadvantages include inevitable complications with respect to overlap and redundancy of factor representation, as well as some considerable complexity of presentation. Because IFs is a thinking tool and an extensively integrated multi-model system, the second approach was adopted, and the production function has become an element of the economic model that will be subject to regular revision and enhancement. See Hughes and Narayan (2021) for an elaboration of the IFs approach as documented here, including explanation of parameterization of driver contributions.

The decision to represent so many productivity influencing variables led to another difference between IFs and many other economic models. Most often the representation of education, for example, is as a multiplier of labor in the production function. Rather than embed each of the multiple productivity drivers of IFs with only either capital or labor (and many, like infrastructure, clearly affect both), all contributions to productivity are represented within a dynamic elaboration of the Solow residual, i.e. as disembodied technological progress.

Stylistically (not using variables names in IFs code), there are four determinants of the growth of multifactor (or total factor) productivity, as indicated below and elaborated in following sub-sections.

The first two contributions represent the conditional convergence process at the core of TFP growth (Abramowitz 1986 and Baumol 1986 provided foundations for the theory of convergence). The first of those two (the Convergence Base Terms) is commonly represented in long-term economic models (e.g., Cuaresma 2017; Dellink et al. 2017) and itself has two components in IFs: (1) the technological progress of systemic leadership or mfpleadr (that role is assigned to the United States, although one can imagine it shifting to China or elsewhere over time; the parameter could be used in scenario analysis in many ways, even including the replication of Kondratieff or “long” waves) and (2) a catch-up technology premium term (MFPPREMIUM) specific to countries and typically related to their GDP per capita as a proxy for ability to adopt and adapt technology (see Johnson and Papageorgiou (2020) for analysis of convergence including its temporal intermittency and variation across country clubs).

The second general contribution driving growth in multifactor productivity (Conditional Convergence Modifications) is quite different in IFs than in other long-term economic models, at least with respect to its extensive elaboration. Specifically, it is the sum of four component elements that can accelerate or slow the conditional convergence process for each country. Those four components, each related to multiple variables in IFs and elaborated in subsequent discussion, represent the degree to which each country’s development of human (MFPHC), social (MFPSC), physical (MFPPC), and knowledge (MFPKN) capital, respectively, are above or below the level of development typically associated with the country’s GDP per capita. If above typical values, convergence is accelerated, and if below, convergence is retarded.

The third contribution driving productivity (Correction Factors) includes two correction terms, one specific to countries (MFPCORS) and one global (MFPGloCor). These can also be thought of as fixed effects terms that represent differences between model-based calculations of productivity growth in the base year and empirical analysis of that growth.

The final contribution contains three parameters that facilitate exogenous control of change in MFPGROWTH for scenario analysis (mfpbasgr, mfpbasinc, and mfpadd). Again, subsequent sub-sections will provide explanation.

In understanding the drivers of economic growth within and across countries and in structuring the IFs representations of productivity and growth, it is essential to have data and measurement of historical productivity and GDP growth patterns. The IFs system includes TFP data series from both the Penn World Tables (Feenstra, Inklaar,and Timmer 2015), also looking to the Conference Board (Erumban and de Vries 2016), which have been used in building the IFs formulation and in historical analysis of it.

Especially for the computation of the correction factors, but also for analysis of some of the other productivity driving factors to be explained below, it is necessary to have an estimate of the basic or core economic growth rate of the country, one that is not influenced by shorter-term events such as cyclical recessions or a pandemic like COVID. The computation of that core growth rate is done in two steps.

First, using historical GDP data the data preprocessor computes a long-term growth rate for each country (igdpr) that, while labeled an initial GDP growth rate, is a propensity for country-specific growth. Having it is important to initialization of the production function and MFP growth formulation, including the conditional convergence representation and the computation of correction factors. Note that igdpr is identified as a parameter in the use of IFs, allowing users to change the computed value easily for scenario analysis. The calculation of igdpr looks to the most recent 20 years of data and near-term future estimates of economic growth (from the IMF), computing average rates of growth in the earliest 15 of those and the latest 5 of those and then computing an average of the two values, weighting them equally and thereby giving more importance to more recent years. It was decided to exclude the years 2020-21 from this computation because COVID’s impact on growth in those years is not representative of the long-term growth patterns and the prospective advance of productivity. One great advantage of having the computation in the preprocessor is that rebasing of the IFs system automatically will continue to update the value of igdpr across time.

Second, even when quite a long historical period is used (with a length that considerably exceeds short-term business cycles and across a 20-year period that is sometimes felt to represent a real-estate-based cycle), countries can experience even quite long periods when GDP growth is greatly disrupted for reasons that we can reasonably expect not to continue. The pattern in Venezuela since the 1999 election of Hugo Chávez is an example. It is very improbable that the long-term growth potential of any country is less that the growth of population; it is possibly a bit more. Therefore, IFs calculates a corrected value of igdpr (igdprcor) that is set at the maximum of igdpr and the population growth rate (POPR) of the country in the base year plus a parameter for the minimum per capita rate assumed to be applicable (minpcgr). In default the value of that parameter is 0.0, but it allows flexibility in scenario analysis.

The following subsections will elaborate each of the four terms in the function that computes productivity growth.

2.3 The Core Representation of Productivity Convergence

As indicated, the Convergence Base Terms consist of two elements, a rate of technological advance at the system’s leading edge (mfpleadr) and a premium percentage productivity growth rate relative to the leader, MFPPREMIUM, which can be negative for some countries. (The rate in the leader's ICT sector gradually convergences over time to that of the service sector.)

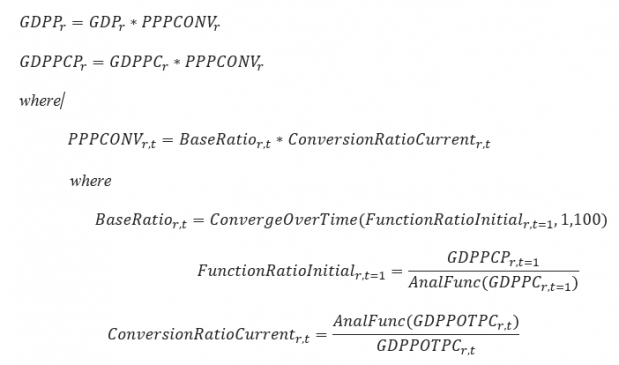

PremTechComp is the name of a function in IFs, driven by the GDP per capita at purchasing power parity (GDPPCP). It computes the technology premium for all countries relative to the annual growth contribution that mfpleadr makes for the leader.

Representation of the function that links GDP per capita to the extent of convergence and divergence relative to the system leader is challenging in part because of the debates that have characterized the literature as to whether the global system’s pattern has been one of divergence or convergence. Pritchett (1997) in writing about “Divergence, Big Time” across well over a century reinforced the argument of many political economists of the time that convergence was very much not the dominant pattern. Even much more recently Johnson and Papageorgiou (2020) argued much the same. In contrast, Hughes and Narajan (2021) traced the shift of global patterns from divergence to convergence near the beginning of the new century and others have also found that shift to be very strong (Patel, Sandefur, and Subramanian 2021). Moreover, contrary to the notion of an invariant or very frequent middle-income trap, these studies suggest more commonly an inverted-U pattern of change in the convergence premium.

Given both the debate within the literature and the relative recency of the seeming global shift from divergence to convergence, the IFs system, which once hard-coded an inverted-U pattern of convergence, has been changed to structure endogenously in the model base year the PremTechComp function using data on world-wide patterns of economic growth in recent years. In the first model year the endogenous calculation of MFPPREMIUM uses igdprcor, mfpleadr, and calculations of labor and capital growth in the production function to compute average values (WBGroupCorrect) for the productivity growth increment in the function above relative to that of the leader within each of the four World Bank country income groupings (low, lower-middle, upper-middle, and high).

The average values of GDP per capita at PPP for each of the World Bank groupings (WBGroupGDPPCP) are also computed in the base year from that pattern in data of recent years. These averages of GDPPCP and computed technological growth premium relative to the system leader are four points that, with interpolation between them, create a conditional convergence function. When the base year for IFs was 2015 and 2017, those values did strongly suggest the inverted-U pattern of convergence across country-specific GDPPCP that began to prevail after about 2000 (the values of the points are visible to model users in techconv). As the model is rebased in future years, however, that pattern may change again. One last specification of importance in using the algorithm for future years is that countries with GDPPCP above that of the leader are assumed in function PremTechComp to have progressively higher negative values of convergence premium. Some, like countries heavily dependent on oil exports are unlikely in the long run to maintain their premium.

2.4 Accelerating and Slowing Conditional Convergence

Given the basic or core representation of conditional convergence as a function of the technological advance of the system leader and the pattern of convergence (or divergence) across other countries, all other terms in the computation of MFP growth across time (MFPGROWTH) are additions or subtractions relative to that core representation. Some of those terms, to be discussed later, are correction factors related to historical growth patterns or exogenous intervention points for scenario analysis. By far the most important increments or decrements are those identified earlier as Conditional Convergence Modifications.

As indicated earlier, those modifications are grouped into four clusters of variables across many of the other models in the IFs system; the clusters are identified as human capital, (MFPHC), social capital (MFPSC), physical capital (MFPPC), and knowledge capital (MFPKN).

The general logic relating each cluster of variables to the growth of multifactor productivity is the same. Each cluster aggregates several variables that generally contribute to productivity. For each variable, such as average years of adult education in the human capital cluster, there is an expected value and an actual value. It is the difference between actual and expected values that gives rise to a quantitively specific positive or negative contribution to productivity and growth.

Most expected values are identified in a relationship with GDP per capita at PPP. That is, there is a tendency for most developmentally supportive variables to advance in a rough relationship of structural development with each other and with GDP per capita (Kuznets 1959 and 1966; Chenery and Syrquin 1975; Syrquin and Chenery 1989; Sachs 2005). To the degree that they do, such advance can be understood to be consistent also with the overall technological advance of the country. If, however, a variable such as years of formal education attained by adults exceeds the typical or expected value for a country at a given level of GDP per capita, we can expect that variable to add something more to productivity. Similarly, falling behind the expected value could retard productivity advance. To illustrate and emphasize this point, even a country for which adult education levels advance could find that education is not keeping up with the advance in other developmental variables including GDP per capita and find that its education levels move from contributing to productivity enhancement to decrementing that productivity enhancement.

2.4.1 Driver Cluster 1: Human Capital

In the human capital cluster there are six variables that add to or subtract from the human capital (MFPHC) term: the educational spending contribution (EdExpContrib), the years of adult education contribution (EdYrsContrib), the quality of adult educational attainment contribution (EdQualContrib), the boost from life expectancy years (LifExpEdYrsBoost) assumed to generate (via mfpedlifexp) extra years of education, the stunting contribution (StuntContrib) related to undernutrition of children, the disability contribution (DisabContrib) related to morbidity from the health model, and vocational education contribution (edVoccontrib) resulting from growth (or decline) in vocational share of lower and upper secondary enrollment,. The first six of these seven drivers have a similar formulation while the formulation for vocational education is slightly different. The first six, as computed often from extended formulations and even other models of the IFs system (as with life expectancy, computed in the health model) are compared with an expected value. In the case of disability, the expected value is set to the world average level (WorldDisAvg), but all other expected values (EdExpComp, EdYrsComp, EdQualComp, LifExpComp, and StuntingComp) are computed as functions of GDP per capita at PPP. As the provision of vocational education does not follow any common pattern or trend and is rather a matter of policy choices made (or will be made) by the particular country, it was not possible to calculate an expected value for this variable. We have instead computed the vocational education contribution from changes in vocational share over time with appropriate moving averages to capture the lag required in materializing such contribution and to smooth out the contribution over time. (Note: In the base case of the model, vocational shares do not change and as such EdVocContrib is zero).

In each case a parameter drawn from study of the literature and/or our own analysis converts the difference between actual and expected into a positive or negative contribution to MFP. (Because of the recursive structure of IFs, some terms rely on variables from the previous time step, estimated from the current time step with the parameter representing corrected core GDP growth, namely igdprcor.)

2.4.2 Driver Cluster 2: Social Capital

The logic of comparison of actual with expected values of six social capital drivers of productivity is the same as that described above for human capital. The six are economic freedom as in the Fraser Institute measure (EconFreeContrib), government effectiveness as in the World Bank measure (GovtEffContrib), corruption as in the Transparency International measure (CorruptContrib), democracy as in the Polity project measure (DemocPolicyContrib), freedom as in the Freedom House measure (FreedomContrib), and conflict as in the IFs project's own measure tied in turn to the work of the Political Instability Task Force (ConflictContrib). In each case other than that for conflict, the expected values (EconFreeComp, GovEffectComp, CorruptComp, DemocPolityComp, and FreeComp) are computed from functions with GDP per capita at PPP. In the case of conflict, the expected value is set at the base year's value (and the comparison is reversed because lower conflict values contribute positively to MFP). A significant amount of the foundational work behind the forecasting of governance related variables including conflict can be found in Hughes et al. (2014).

2.4.3 Driver Cluster 3: Physical Capital

The logic of the physical capital cluster is again parallel to that of the human and social capital clusters and involves the comparison of an actual (that is, IFs computed) with an expected value. The formulation for MFPPC can take several forms depending on the value of a switching parameter (inframfpsw) but the standard form involves four contributions, from traditional infrastructure (InfraTradContrib), ICT infrastructure (InfraICTContrib), other infrastructure spending level (InfOthSpenContrib), and the price of energy (EnPriceTerm). The last term is included because higher prices of energy can make some forms of capital plant no longer efficient or productive.

In the case of this cluster only the expected value of the traditional infrastructure index (InfraIndTradComp) and the expected value of other infrastructure spending (InfraOthSpendComp) are computed as most other cluster elements are, namely as a function of GDP per capita at PPP. In the case of the ICT index contribution, the technology has been evolving so rapidly that there is not really a basis for an expected value with some stability over time. Instead, the expected contribution from ICT is computed using a moving average value of change over time, so that faster rates of change contribute more to MFP if the moving average expected value lags behind the actual. In the case of the energy price term, the expected value is set equal to the energy price in the first year of the model run. As with variables in other clusters, a single parameter links the discrepancy between actual and expected values to MFP. A significant amount of the foundational work behind the forecasting of infrastructure related variables including conflict can be found in Rothman, et al. (2014).

2.4.4 Driver Cluster 4: Knowledge Capital

Following the pattern of other MFP driver clusters, the one for knowledge accumulation includes terms that compare actual model and typical or expected values and use parameters to translate the differences into increments or decrements of MFP. In this case the three terms represent R&D spending (RDExpContrib), economic integration via trade with the rest of the world (EIntContrib) and the tertiary graduation rate in science and engineering (EdTerSciContrib). In the first and third cases the expected values (RDExpComp; EdTerGRSciEnComp) are functions of GDP per capita at PPP. In the second instance, there is no clear relationship between extent of economic integration and GDP per capita, so the model compares a moving average of trade openness (exports plus imports as a percentage of GDP) with the initial value of openness (because trade is computed later in the computational sequence for each year, the values of trade variables lag one year behind those of the production function). Given the extreme global range of trade openness, the elasticity term itself in this relationship is variable, with values decreasing when initial openness is greater (that is, countries that start with less openness gain more from the same percentage point increases in it). Given computational sequence, values of EDTERGRSCIEN and some of the other actual terms are lagged.

2.4.5 Parameterization and Interaction Effects

The aggregation of so many driving variables into the representation of total factor productivity raises two interrelated methodological issues: parameterization of each variable’s contribution to modification of the core computation of productivity convergence and the interaction effects among those contributions.

The IFs project efforts to address these issues fall into three categories: (1) looking to the literatures around the contributions to productivity of individual variables and clusters of them; (2) extended statistical analysis of our own across the multiple variables in the four clusters; and (3) an arbitrary reduction of especially large increments and decrements associated with any of the four clusters.

Attention to literature supports the development and use of IFs. With respect to parameterization of the contributions of variables to productivity change, that attention has been constant across time. Illustratively, Barro and Sala-i-Martin (1999: 433) estimated that a 1.5% increase in government expenditures on education translates into approximately a 0.3% increase in annual economic growth. Globerman (2000) reviewed empirical work on the private and social returns to R&D spending and found them to be in the 30-40% range; see also Griffith, Redding, and Van Reenen (2000). The Handbook of Development Economics (especially volume 2) is a rich font of information on the empirics of growth. Hughes (2005) documented the original creation of the structure and its parameterization based mostly on existing literature.

Hughes and Narayan (2021) documented an extensive statistical analysis of drivers of change in total factor productivity within the IFs project. Much of that work was focused on analyzing and addressing multicollinearity in an approach involving so many driving variables. The project has dealt in part with this by selecting conservative values for the parameters when studies indicate possible ranges of contribution of the variables to productivity and/or growth.

Another concern is that a very large or extreme advance by one or a small subset of variables could have inappropriately large impacts of productivity given the fundamental conceptual foundation of the approach in the notion that development involves widespread and reinforcing structural changes across many variables. To limit this possibility, we have created an algorithmic function (MFPContribAdj) that adjusts the multiple MFP contributions and dampens especially high positive or negative contributions among the four cluster terms (MFPHC, MFPSC, MFPPC, and MFPKN).

2.5 Correction Factors in Computation of Productivity Growth Rate

As elaborated earlier (Section 2.2) and shown again in the equation below, in computing the sector-specific stock of multifactor or total factor productivity (TEFF), the endogenous growth of that every year (MFPGROWTH) is the sum of four contributions. The first two of those discussed to this point are the Convergence Base Terms (from the productivity growth of the technological leader and the GDP per capita based convergence term) and the Conditional Convergence Modifications of those (tied to patterns of change in human, social, physical and knowledge capital). Given discussion above of those two, it is possible now to move to the third, Correction Factors. Those factors include a country- and sector-specific correction factor (MFPCORS) and a global correction factor (MFPGLOCOR). MFPCOR is a value added-weighted average across sectors of MFPCORS. The corrections to sector-specific MFPGROWTH are required to assure that the base rate of aggregate economic growth for a country/region that is unexplained by capital and labor growth in the model’s base year can be attributed to the representation of productivity.

The computation of MFPCORS in the base year has five steps:

1. Determination of each country’s basic propensity for annual economic growth (already done/explained and put into igdprcor, see Section 2.2). What remains to be done is the computation of sector-specific basic growth rates (SectorGr).

2. Initial calculation of sector specific MFP’s contribution to growth (MFPGROWTH) from that basic propensity by subtracting out the sector-specific capital and labor contributions to value added growth as predicted from SectorGr.

3. Initial calculation of sector-specific correction (MFPCorSI) factors by comparing that initial calculation of MFPGROWTH with the endogenous computations of the Convergence Base Terms and the Conditional Convergence Modifications.

4. Using the sector-specific corrections and base year value added terms to compute a global correction factor (MFPGLOCOR) that is not specific to country or sector as an extra check on matching all drivers of MFPGROWTH with global growth.

5. Final computations of country and sector specific correction factors (MFPCORS) for use in MFP forecasts of future years.

The following sub-sections elaborate these steps.

2.5.1 Specifying Long-Term Economic Growth Propensity by Sector

Although igdprcor represents total national economic growth, growth in value added will vary by sector. It may be especially different between agriculture and other sectors, but IFs does not have a strong sectoral growth database. There is reason to believe, in particular, that the growth in the agricultural sector is likely to be different from and normally less that than in other sectors. IFs internally computes a sectoral economic growth rate (SectorGR) that ties the estimated value added growth of the agricultural sector to the preprocessor estimated growth rate of yield (TGRYL). For higher-income countries (with a GDP per capita above $5,000) it sets the agricultural sector’s growth rate at that yield growth level; it assumes that lower income countries depend more heavily on expansion of land as well as yield and sets the sectoral growth rate at twice the yield growth rate (and at least half of igdprcor). For other sectors the growth rate is set at igdprcor. The resultant deviation of growth in agricultural value added from igdprcor is spread proportionately across all other sectors to assure no change in national total growth expectation. Because its earlier surge of growth has ended, an additional block of code bounds growth in all Chinese sectors at 8.5%.

Attention to differential sectoral growth rates is important because of their differential labor productivity and the migration of labor across sectors. Many lower-income countries are experiencing a significant process of population migration from rural to urban areas with an associated movement of labor from agriculture to other sectors where that labor and associated capital produce more value added (albeit often with interim movements into the less productive informal economy, an issue returned to in Section 7). IFs represents these migration and labor shift processes. If the initial structuring in IFs of economic growth drivers including the correction terms within MFPCORRECT did not take them into account, forecasts of economic growth in years after the base year would very rapidly accelerate beyond the core rate imbedded in igdprcor. In fact, even with attention given in the base year initialization to adjustments of SectorGR representing this intersectoral growth accelerating process already underway and therefore showing up in igdprcor, growth projections for many lower-income countries in IFs show further acceleration of economic growth across much of the first half of this century. These model formulations will benefit from continued attention and review to understand the degree to which such acceleration is an insight rather than a weakness in representation.

2.5.2 Calculation of MFP Growth by Sector

Given an estimate of sector-specific, long-term growth propensity for value added (SectorGR), it is possible to compute a “predicted” time-independent value added VAddPred) as that of the base year plus that core value of sectoral growth.

Given this expectation for sectoral growth, to compute the contribution of MPF to that growth by sector (MFPGROWTH) we must also estimate and back out the long-term contributions of the capital and labor terms in the Cobb-Douglas function to sectoral growth propensity.

In aggregate for a country, the long-term growth rate in capital stock is determined by the ratio of gross capital formation (IGCF) to GDP, which covers both depreciation of and addition to capital. IFs uses a function called “Investment Ratio Versus Capital Growth Rate” to compute a total country-specific rate of growth for capital stock (KGroComp), net of depreciation, and assigns that to each sector (KGroCompS). During project tuning with the model it was determined that the value produced by the stylized function was too high; it is arbitrarily cut in half with the sectoral calculation.

The need to adjust the net capital growth estimate appears to have roots in three limitations that additional data on sectoral capital stock, investment, and rates of change in value added would help address. The first limitation is related to the use of the above function based on aggregate national investment rate for computing estimates of the net change in sectoral capital stock. Ideally, we would want to begin with historical data on sectoral capital stocks. The second limitation is estimating gross investment to sectors (IDS), together summing to gross aggregate national investment (IGCF), based on sectoral value-added shares of the total national value added. Ideally, we would also want data on sectoral investment. The third limitation is the use of those sectoral investment values to compute sectoral capital stock in the first year; that is done using sectoral depreciation rates as the inverse of the sectoral lifetime of capital (lks) and the sectoral estimates of net change in capital stock (KGroCompS).

The good news is that having these initial conditions and relationships, even if not as strongly rooted in data as desired, it is possible to compute an estimate of the propensity for contribution of annual change in capital stock to economic growth (KContrib). That estimate needs to use a value also for the Cobb-Douglas parameter on capital (PCDAlf).

Moving to labor, the long-term propensity for growth rate in the size of the labor force (LfGr) is primarily determined by the growth of population (POPR), the initial share of females in the work force (FemShrLabI), and the growth rate of the female share (FemShrGr).

Having rate of growth of the labor force allows computation of labor’s propensity for contribution to sectoral value-added growth in the same way as is done for the capital contribution, but it uses the forward-looking labor term parameter (1-PCDAlf). A small adjustment term is added to the basic growth of labor to capture the slow increase in skilled labor share (LabFGroRateAdj).

Finally, having (1) sectoral value added that long-term growth would be expected to generate and (2) the anticipated contributions to that growth of capital and labor, it is possible to isolate the growth rate that would be necessary from MFP (MFPGROWTH) to generate the predicted value added given core sectoral growth rates.

2.5.3 Computing an Initial Country and Sector Specific Correction

At this point it is possible to compute an initial estimate of the country-sector specific correction factors (MFPCorSI) because all of the terms that are supposed to drive MFPGROWTH in future years have been determined. These include the Conditional Base Terms, namely the technological or MFP growth rate for the leader (mfpleadr) and the convergence premiums for countries (MFPPREMIUM), as well as the four elements of Conditional Convergence Modifications (increments or decrements from MFPHC, MFPSC, MFPPC, and MFPKN, driven by many other variables of the IFs system).

2.5.4 Computing a Global Correction Term

The sector-specific, value-added weighted sum across countries and sectors of these discrepancies in calculation of MFP contributions relative to the calculation of the MFP growth to be explained will inevitably be non-zero given the many factors that underly the forecasting of economic growth and the many uncertainties around each. It could well be that there are systematic issues/errors in the formulation. One way of knowing that and of building in a correction is to sum the entire country-sector set and to compute the percentage of global GDP (the sum of VADD) within a global error and correction factor (MFPGLOCOR).

2.5.5 Computing the Final Country and Sectoral Specific Connection

Adjusting for the global correction factor assures that the Base Case forecast of global growth will, at least in the early years, not be significantly different from that the recent years on which the calculations of igdpr (and therefore VADDPred and MFPGROWTH in the first year) were based.

After that global adjustment there will remain differences between the values expected for those of individual countries and sectors, and those will be maintained in the final version of the MFPCORS correction factor that is computed in the base year and used in calculation of MFPGROWTH in future years.

Thus, in the base year the following equation for MFPGROWTH will continue to hold.

2.5.6 Exogenous Parametric of MFP beyond the base year

In years beyond the base year, the model allows Exogenous Interventions (adjustments) to MFPGROWTH. There are three parameters (with zero values as the default) that allow the model user much additional control over assumptions of technological advance. The first is a basic parameter (mfpbasgr) that allows a global growth increment or decrement; the second is a parameter (mfpbasinc) that allows either a constant rise or slowing of growth rate globally, year by year, where zy is the count of the model run years across time. The final exogenous term is a frequently-used parameter (mfpadd) allowing flexible scenario intervention for any country/region. The addition of these exogenous terms completes the formulation of MFPGROWTH to be used in years beyond the first, tying that formulation back to the initial introduction of it in Section 2.2 of this documentation.

In years beyond the first, the correction factor is gradually reduced to zero across time (the period specified by mfpconv) with the presumption that the full forecasting formulation is fundamentally strong and that even the 20-year base period on which igdprcor was based will have had its own idiosyncrasies. This convergence assumption has significant implications for model behavior because it tends (1) to slow down growth in countries (like China) that have had a burst of growth beyond that which the rates of the leader and the catch-up factor would lead us to anticipate and (2) to speed up growth in countries (like the transition states of Central Europe) that have suffered a reduction similarly unexpected by the basic formulation.

2.6 Monitoring Productivity Across Time

Additional variables in IFs facilitate the monitoring of elements of productivity across time. Most important is MFPRATE, which maintains all elements in MFPGROWTH except the four conditional convergence adjustment terms. MFPRATET is a VADD weighted sum of it for each country. Note: in the first model year MFPRATE is used in multiple steps in the creation of the MFPPREMIUM function, in the initial correction factor calculation, and in the final correction factor equation; the variables it incudes change across these steps, but its final calculation is consistent with the equation for subsequent years.

The model code for MFPGROWTH in years beyond the first uses MFPRATE rather than spelling out its components. Thus

where

Some additional variables facilitate monitoring of changing productivity levels:

MFPBAS is a country-specific average of MFPRATE values smoothed across time using a moving average of value added (SmVADD). Contrast it with MFPRATE, which uses annual VADD rather than SmVADD.

MFPCOR is a country-specific average of MFPCOR values smoothed across time using a moving average of value added (SmVADD).

MFPTOT is a sum of MFPBAS, the four conditional convergence modification terms and MFPCOR.

2.7 Issues and Modifications of Productivity and Growth

2.7.1 Changing Factor Contributions and Returns: CDALF

The Cobb-Douglas exponent (CDALF) of the production function is known to change over long time periods, generally giving somewhat less weight to capital (and therefore less return to it) as an economy becomes more capital intensive and therefore richer (see, for instance, Thirlwall 1977: chapter 2).

The GTAP project data provided the basis for an estimation of this relationship. The resultant cross-sectionally estimated function, in combination with data on sectoral differences in capital share, allow the computation of sectoral capital shares (AlphaS), normalized (with value added VADD) so as to generate CDALF for the total economy. A parameter (salpha) represents a generic pattern of capital share variation across production sectors.

where

Because the Cobb-Douglas exponents affect not just the relative contributions to production capital and labor but also the shares of GDP that firms and households receive, it will also significantly affect the financial flows within an economy, an issue to which we return in the discussion of the social accounting matrix.

2.7.2 The Relationship of Partial Equilibrium Models to the General Model

IFs normally does not use the economic model's equations representing MFP and production for the first two economic sectors, because the agriculture and energy models provide gross production for them (unless those sectors are disconnected from economics by setting the agon and/or enon parameters to zero). Instead, the two physical models provide gross production, translated to value terms with prices, back to the economic model. A later section of documentation (see 3.1.1.2) provides discussion of gross production and its relationship to value added and intersectoral flows.

In addition to this impact of the physical models on the production side of the economic model, there is one more of importance. Physical shortages of energy may constrain actual value added in each sector (VADD) relative to potential production. Economists typically do not accept such shortages as a real-world phenomenon because (at least in theory) prices rise to clear markets; yet during periods like the 1970s when governments intervened in those markets, such shortages do appear and they can in some IFs scenarios. In those situations, IFs assumes that energy shortages (ENSHO), as a portion of domestic energy demand (ENDEM) and export commitments (ENX), all calculated in the energy model, lower actual production in all sectors through a physical shortage multiplier factor (ShoMF). A parameter/switch (squeeze) controls this linkage and can turn it off.

where

2.7.3 The Economic Impacts of Climate Change

The energy and agriculture models (documented separately) produce carbon dioxide emissions from fossil fuel usage and changes in forestation levels that raise atmospheric levels and global temperatures (WTEMP). The changes in WTEMP have direct impact on agricultural yields, as does to a lesser degree the carbon fertilization of increased atmospheric levels. This passes through to agricultural production levels and enters the economic model as gross production of the agricultural sector, as discussed earlier. In addition, rising temperatures have complex implications for the broader economy, the focus here (see also Hughes 2019).

An issue that representations of climate impact in dynamic models must address is the extent to which damage to the economy occurs only in discrete time periods and the extent to which damage in any given year carries forward with implications for future years also, thus compounding the impact over time. In modeling it is simple to represent damage with a multiplier on the production function affecting each period’s GDP individually, and Nordhaus (2016) has taken this approach with DICE. Economic damage in a single period can, however, lower investment, and therefore capital stock and knowledge in the longer term (although it can also be argued that such damage often mobilizes unused resources, an element of adaptation). Elaborating cumulative and compounding impact, Dietz and Stern (2015: 579–580) argued that climate-related economic damage directly affects and reduces the stock of existing capital (e.g., direct damage to it or abandonment in instances such as sea-level rise) and even associated multifactor or total factor productivity (TFP). Use of a model like DICE or FUND with the addition of capital and productivity stock damage to that affecting annual production (a flow) can considerably increase the assessment of potential climate change cost at end of century to as much as 20 percent of GDP (Stern 2007, using PAGE02). An OECD study (2015: 81–84) also addressed this issue. That study’s analysis, using a version of the DICE model and directing 30 percent of annual damage to TFP and the rest to annual GDP, reduced annual GDP at the end of the century relative to a no-impact baseline by about 11 percent.

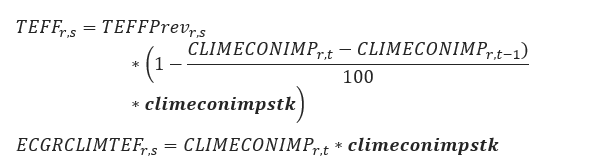

In IFs a switch (climeconimpsw) turns on the impact of climate for the nonagricultural economy. That switch, set on by default, activates a statistically aggregated approach for impact of warming on sectors of the economy other than agriculture (the impact of climate change on crop production and gross agricultural production is computed in the agriculture model and fed to the general economic model as described earlier). For non-agricultural and non-energy sectors IFs computes the magnitude of economic damage (CLIMECONIMP) resulting from the change in global temperature (WTEMP) relative to the temperature of the initial model year. The formulation is similar to the quadratic equation of cost-benefit models like FUND, DICE, and PAGE and computes the damage as a percentage of GDP, using linear and quadratic terms. The parameterization for those two terms (climeconimplin and climeconimpsq) looks to the work of Nordhaus and others. CLIMECONIMP is actually computed in the IFs environmental model, but we show that computation here because of its important use in the economic model in adjustment of both value added and productivity.

The damage reduces value added (VADD) by sector (which is an annual flow term), relative to the previous computation of it in the Cobb-Douglas function (reported below as VADDPrev, but in the IFs code VADD is on both sides of the equation’s code line).[1]

The difference in the equation above between climate impact in the current versus the first year of the model is actually carried inside the model via an internal variable (ClimImp) and put into ECGRCLIMGDP to help users of IFs see the size of the annual impact.

As discussed, it is possible that climate-related impacts are not only on annual production (with some future impact via reduced savings and investment), but also directly on capital stock and/or total factor productivity (TEFF). IFs uses another parameter (climeconimpstk) that is turned on by default to represent the portion of economic damage that might affect productivity as previously calculated (TEFFPrev) and driven over time by MFPGROWTH. Because TEFF is a stock term, the change in it is driven by year-to-year differences in the level of economic impact. The magnitude of the accumulated parameterized impact of climate change on TEFF is shown to the model user in the variable ECGRCLIMTEF.

IFs does not deal well with some of the challenges that face all modeling of climate change impact. For instance, it does not explicitly represent the impact increased weather volatility or extreme events, although those affects can be presumed to appear in the broader logic of climate impact via the parameterization of it from sources that do focus on the broad range of climate impacts.

With respect to time horizons, most analyses of climate impact on the economy stop at 2100 as does that in IFs. But atmospheric carbon increases will persist much longer. It is for this reason that analysis with FUND can extend through 3000 and that with PAGE through 2200. A central purpose of those models is to determine the social cost of greenhouse gas emissions, often conceptualized as the long-term cumulative cost per ton of current carbon dioxide equivalent emission, with final values often computed by applying a discount rate to future costs. The purpose of the analysis of economic impacts in IFs is to close the loops that connect the economy, climate change, and all other models in the IFs system.

2.7.4 The Economic Impacts of the Informal Economy

Section 7 of this documentation details the representation of drivers of the informal economy. Here we focus on the effects of that informality on economic productivity and therefore growth. Whereas climate change is progressing from a relatively low base of impact and therefore is affecting both immediate GDP and underlying productivity patterns that historically were less or even little affected by it (for instance, little impact on igdprcor), economic informality has long been with us and is already baked into historical levels and growth rates of GDP. Thus, the representation of climate change economic impact in IFs significantly builds on absolute levels of it and represents the impact of increase in those for both GDP and productivity, whereas the representation of informality impact looks much more to changes (and often reductions) of that impact on productivity alone, letting those impacts then pass through to GDP.

We have structured the forward linkages from informality so that the model user can drive them with either the size of the informal economy (GDPINFORMSHR) or the size of the shadow economy (GDPSHADOWSHR) with differences in concepts and database described in their documentation. The logic of economic impact is the same in either case. Which concept and forecasts of change are used depends on the value of the shadow economy switch (gdpshadowon). If that parameter is 0 (the default) the driver is the informal economy share; if it is 1, the driver is the shadow economy share.

The fundamental driver of changes in economic productivity is the excess or deficit in the informal GDP share (ExDefInfGDP), relative to an expected value. This approach thus has much in common with that of modifications to productivity related to human, social, physical and knowledge capital.

We elaborate here the manner in which that excess or deficit affects total (or multifactor) productivity. Section 3.4.1.2 within the subsequent documentation of the social accounting matrix will then turn to the manner in which it affects taxation and therefore government revenues and expenditures.

The key to the productivity linkage is to recognize that an informal economy (or a shadow economy but to a much lesser degree) has the tendency, particularly in developing countries, to generate an official GDP that is lower than the potential GDP (PotentialGDP), because labor is employed with less capital and less efficiency in the informal sector. The magnitude of this productivity cost of informality (InfCost) can be illustrated by the fact that the data for some economies suggest that while 60 percent or more of labor can be informal, only 20 percent of GDP might be informal. This illustratively suggests that each unit of informal labor in such a country is used only about one-third as productively as is formal labor (we compute the ratio as the inverse, suggesting that each surplus unit of informal or shadow economy in this example could have a productivity cost of 3; we further bound that ratio so that it cannot exceed 3 or fall below 1, not shown below).

If gdpshadowon=0 then

else

It is important to emphasize, however, that the productivity and GDP growth rates in the basic IFs model already reflect the size of each country's informal GDP share and whatever drag or boost that share is giving to growth. Moreover, normal patterns of change in the informal GDP share (and that the share tends to decrease over the long-run with advance in adult formal education and/or GDP per capita), are essentially already built into the long-term dynamics of productivity change in IFs, for instance the basic growth rate and the conditional convergence or catch-up of productivity in developing countries with higher income countries. Thus, our attention here is not to the basic impact of informality on growth, but the incremental impact that deviations from the normal or expected size of the informal sector and the normal or expected change in that size might have on productivity. We can refer to such deviation as excess or deficit informal GDP share (ExDefInfGDP).

This point is so important that it bears rephrasing and repeating in only slightly different language. Why is this excess or deficit important? The dynamics of the IFs system's basic forecasting of economic productivity and GDP and of government revenue and expenditure patterns are all built on historical patterns and estimated functions that represent the normal processes within countries of gradual reduction of informal economy size with socioeconomic development. Thus, a normal decrease over time in the informal economy size should not be allowed to further affect the dynamics of productivity (or government finance). Similarly, if a country has a persistent and stably larger or smaller informal economy than would be expected at its level of socio-economic development, with GDP per capita at PPP serving as a proxy for that—it should have normal productivity and finance dynamics. It will be countries that change the share of the informal economy relative to their expected values with development, and that therefore demonstrate changes in the excess or deficit of the informal GDP share relative to expected share (ExDefInfGDP) that will alter their expected development pattern.

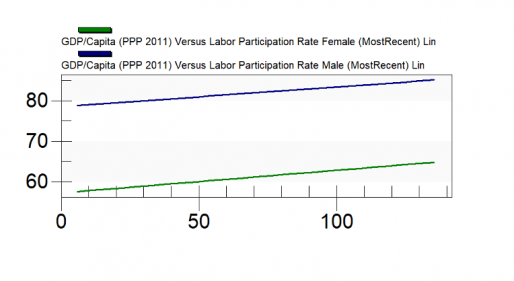

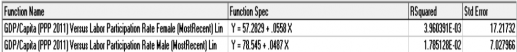

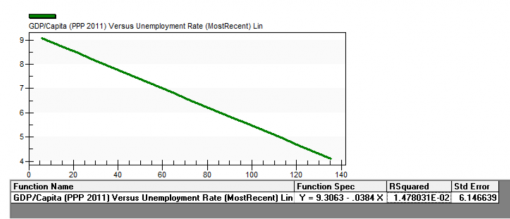

To compute the excess or deficit informal share we need only to explain the calculation of the expected share (GDPInformShrExp). That calculation uses a function estimated against GDP per capita at PPP, namely "GDP/Capita (PPP 2011) Versus Informal Share of GDP (Most Recent) Log." The same is true for the shadow economy and its share.

Over time this expected level is then subtracted from forecasts of the informal share, and the difference is divided by 100 to calculate the excess or deficit (ExDefInfGDP) in the extent of informal activities in ratio rather than percentage terms.

If gdpshadowon=0 then

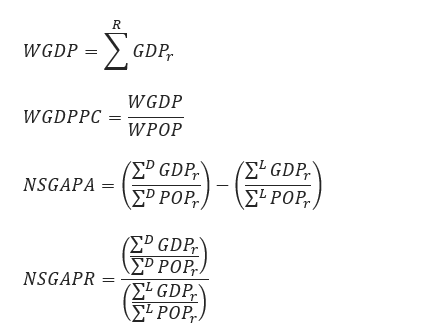

else