Energy

The most recent and complete energy model documentation is available on Pardee's website. Although the text in this interactive system is, for some IFs models, often significantly out of date, you may still find the basic description useful to you.

The energy model combines a growth process in production with a partial equilibrium process. The energy model automatically replaces the energy sector in the full economic model unless the user disconnects that linkage.

For energy, the partial equilibrium structures have distinct demand and supply sides, using price to seek a balance. As in the economic model, however, no effort is made to obtain a precise equilibrium in any time step. Instead stocks serve as a temporary buffer and the model again chases equilibrium over time.

Gross domestic product (GDP) from the economic model provides the basis for energy demand calculations. Energy demand elasticities tend, however, to be quite high. Thus the physical constraints on the supply side are terribly important in determining the dynamics of the energy model.

IFs distinguishes six energy production categories: oil, natural gas, coal, hydroelectric, nuclear, and other renewables. For each category both conventional and unconventional sources are considered, but these have only been fully implemented for oil. IFs computes only aggregated regional or national energy demands and prices, however, on the assumption of high levels of long-term substitutability across energy types and a highly integrated market. The model also conducts energy trade only in a single, combined energy category. Finally, at the moment, there is not a full connection between the energy model and access to electricity and electricity production (see the IFs Infrastructure Model Documentation for a description of the electricity aspects of IFs).

Structure and Agent System: Energy

System/Subsystem

|

Energy

|

Organizing Structure

|

Partial market

|

Stocks

|

Capital, resources, reserves

|

Flows

|

Production, consumption, trade, discoveries, investment

|

Key Aggregate Relationships (illustrative, not comprehensive)

|

Production function with exogenous technology change; Energy demand relative to GDP; Price determination

|

Key Agent-Class Behavior Relationships (illustrative, not comprehensive)

|

Government taxes, subsidies

|

Dominant Relations: Energy

Energy demand (ENDEM) is a function of GDP and the energy demand per unit of GDP (ENRGDP). Energy production (ENP) is a function of capital stock in each energy type, the capital/output ratio (QE) for that energy type, and a capacity utilization factor (CPUTF).

The following key dynamics are directly linked to the dominant relations:

DEMAND Energy demand per unit of GDP depends on GDP per capita, energy prices, and an autonomous trend in energy efficiency. The first two of these are computed endogenously, the latter exogenously. The user can control the price elasticity of energy demand (elasde ) and the autonomous trend in efficiency of energy use (enrgdpgr ). The user can also use an energy demand multiplier (endemm ) to directly modify energy demand.

PRODUCTION For fossils fuels and hydro, there are upper bounds on production. For fossil fuels, these are based on reserve production ratios, as well as user-specified upper bounds (enpoilmax , enpgasmax , and enpcoalmax ). For hydro, the upper bound relates to hydropower potential. The model user can also control production using an energy demand multiplier (enpm ) to directly modify energy production by energy type.

CAPITAL/OUTPUT RATIO The capital/output (capital/production) ratios for all fuel types decline over time due to technological improvements at rates determined by two user controllable parameters (etechadv and etechadvuncon ). For fossil fuels, this is counteracted by a factor that increases the capital/output ratio as the amount of remaining resources decreases. Something similar happens for hydro and other renewables, but here the capital/output ratios increase as production approaches a maximum possible level. The user can further modify the capital/output ratios with the multipliers (qem and qeunconm ).

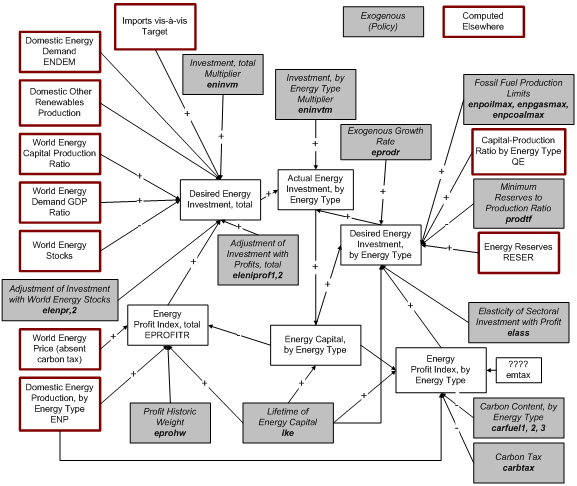

CAPITAL Energy capital, by fuel type, is initialized based on the initial levels of production and capital/output ratios. Energy capital depreciates at a rate determined by the lifetime of energy capital (lke ) and it grows with investment. Total desired investment in energy capital is influenced by many factors, including existing capital, domestic and global energy demand, the production of other renewables, changes in the global capital/output ratio, world and domestic energy stocks, expected overall profits in the energy sector, and imports. Users can influence this in the aggregate (via eninvm ) and can also control the effect of expected profits (eleniprof and eleniprof2 ) and world energy stocks (elenpr and elenpr2 ). Desired investment by energy type increases with individual profit expectations, but also by limits related to reserve production factors (for fossil fuels and hydro), any exogenous restrictions on maximum production (for fossil fuels), ultimate potential (for hydro), and other, unspecified factors (nuclear). Users can influence the effect of profit expectations by fuel type (via elass ) as well as influence the desired investment by energy type in the aggregate (via eninvtm ). The user can also specify an exogenous growth rate for energy investment by fuel type (eprodr ). The economic model ultimately determines whether all of the investment needs can be met; in case of shortfalls, the investment in each type of energy is reduced proportionately.

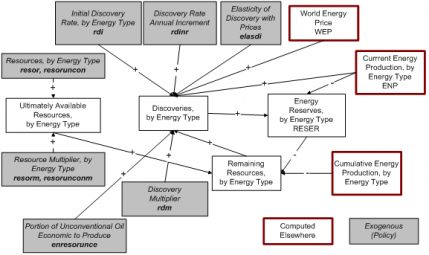

RESOURCES/RESERVES/STOCKS IFs separately represents ultimate resources and reserves, where the latter are the amount of energy resources available to be produced. Resources and reserves, both conventional and unconventional, are set in the pre-processor. The user can modify the default assumptions on ultimate resources, either directly (resor , resoruncon ) or via the use of multipliers (resorm , resorunconm ). Reserves decline with production and increase with discoveries. The rate of discovery depends on the ultimate resources remaining, the intensity of current production, world energy prices, and a base rate of discovery (rdi ). The user can control the effect of world prices on discovery (elasdi ), augment the base rate of discovery (rdinr ), and use a multiplier to affect the rates of discovery (rdm ). Finally, IFs keeps track of any production not used in the current year, i.e., stocks, and shortages.

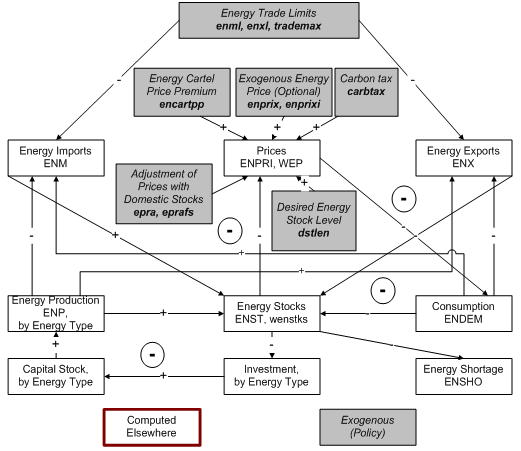

ENERGY PRICES Domestic energy prices are influenced by world stocks, domestic stocks, and the ratio of capital to production at the global level. The user can control the effect of domestic stocks on prices (epra and eprafs ). Users can also include a “cartel premium” (encartpp ) and a carbon tax (carbtax ). More directly users can set domestic energy prices exogenously for just the first year (enprixi ) or for multiple future years (enprix ). The world energy price is calculated as a weighted sum of the domestic prices.

TRADE The energy model also provides representation and control over energy trade. The levels of imports and exports depend upon levels of production and demand, as well as past propensities to import and export energy. The user can set maximum limits on of energy imports (enml ) and energy exports (enxl ), as well as general limits on trade (trademax ).

Energy Flow Charts

Overview

The production growth process in energy is simpler than that in agriculture or the full economic model. Because energy is a very capital-intensive sector, production depends only on capital stocks and changes in the capital-output ratio, which represents technological sophistication and other factors (such as decreasing resource bases) that affect production costs.

The key equilibrating variable is again inventories. It works via investment to control capital stock and therefore production, and via prices to control domestic consumption. Production and consumption, in turn, control trade.

Specifically, as inventories rise, investment falls, restraining capital stock and energy production, and thus holding down inventory growth. As inventories rise, prices fall, thereby increasing domestic consumption, which also holds down inventory growth.

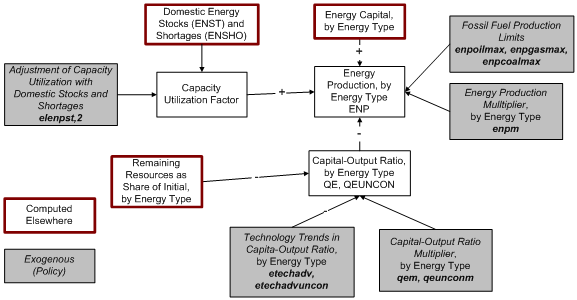

Energy Production Detail

Energy production is a function of the capital stock in energy and the capital-output ratios, modified by a capacity utilization factor and exogenous multipliers and production limits. The capital-output ratios are affected by the amount of remaining resources as a share of the initial levels, technological progress, and user-controlled multipliers. The capacity utilization factor is influenced by domestic stocks and shortages.

Energy Capital and Investment Detail

The capital stock by energy type decreases with depreciation and grows with investment. Investment or growth in the capital stock, while affected by numerous factors, is driven heavily by energy profits and stocks (unless the user intervenes with a scenario multiplier), and constrained by the reserves available of each specific energy type and production constraints. The user can use a direct multiplier on total energy investment, multipliers on energy investment by energy type to influence investment, or specify a desired rate of growth in investment by energy type.

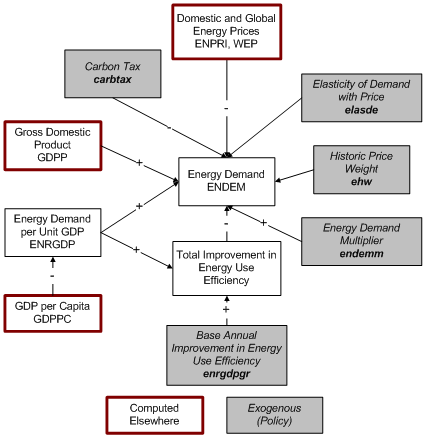

Energy Demand Detail

Energy demand is estimated as a function of the energy demand per unit GDP (in PPP terms) and total GDP (in PPP terms), with adjustments related to energy prices and improvements in energy use efficiency. The energy demand per unit GDP depends on GDP per capita (in PPP Terms). The improvement in energy use efficiency is a combination of autonomous trend in efficiency of energy use (enrgdpgr ) and an additional amount that accelerates the improvements for (non-exporting) countries that have efficiencies below the global average. The price effect takes into account both the domestic and global prices of energy, as well as any carbon tax (carbtax ). The user can control the price elasticity of energy demand (elasde ) and the historical weight used to smooth energy prices (ehw ). Finally, the user can also use an energy demand multiplier (endemm ) to directly modify energy demand.

Energy Resources and Reserves Detail

IFs distinguishes between ultimate resources and reserves, where the latter represent the amount of energy actually discovered and available for production. Ultimate resources are initially determined in the pre-processor, but the u

ser can override these estimates using either absolute values (resor , resoruncon ) or multipliers (resorm , resorunconm ). There is also a parameter controlling the portion of unconventional oil that is economic to produce (enresorunce ). For non-renewable energy types, i.e., fossil fuels, reserves increase with discoveries and decrease with production. The rate of discovery includes a base rate (rdi ) and an annual increment (rdinr ). There are further adjustments related to the world energy price, the remaining resources, and the current rate of production. The user can control the effect of world prices on discovery (elasdi ) and can also intervene with a discovery multiplier (rdm ).

<header><hgroup>

Energy Equations

</hgroup></header>

Overview

This section of the Help system will present and discuss the equations that are central to the functioning of the energy model: supply, demand, trade, stocks, price, investment, economic linkages, capital, natural resources and energy indicators. Here we follow the order of calculations in all years but the first, noting specific calculations that are made in the first year or pre-processor as necessary. <header><hgroup>

Energy Demand

</hgroup></header> The key energy demand variable in IFs, ENDEM, tracks total primary energy demand. For the most part, IFs does not represent the transformation of this primary energy into final energy forms, or end-user energy demand. The one exception relates to electricity use, which is described in the documentation of the Infrastructure model.

In the first year, total primary energy demand is calculated as an apparent demand, with attention paid to stocks and expected growth in production.

http://www.du.edu/ifs/help/media/images/eng-module/engeq1.png

where

- ENP, ENM, ENX, ENST, and AVEPR are energy production, energy imports, energy exports, energy stocks, and an average of the expected growth in production across all energy types. The calculations of the initial values of these variables are described later in the Equations section under the appropriate headings.

Note that this calculation does not directly use the historical data on total primary energy demand and there can be a significant difference between the initialized value of ENDEM and the actual historical data for the base year. This information is used by the variable ENDEMSH, which is described in the Infrastructure documentation.

In future years, the calculation of total primary energy demand begins with an estimate of the predicted amount of energy demand per unit of GDP (in PPP terms), compendemperunit, as a function of GDP per capita (in PPP terms).[1] This function is show in the figure below[2]: