Infrastructure: Difference between revisions

StellahKwasi (talk | contribs) No edit summary |

StellahKwasi (talk | contribs) No edit summary |

||

| Line 32: | Line 32: | ||

Each of these steps are described in more detail below. [[File:Health16.png|border|center|Health16.png]] | Each of these steps are described in more detail below. [[File:Health16.png|border|center|Health16.png]] | ||

For more on the infrastructure module, see the links below | For more on the infrastructure module, see the links below | ||

== Structure and Agent System: Infrastructure == | == Structure and Agent System: Infrastructure == | ||

| Line 319: | Line 319: | ||

| style="text-align: center; padding-left: 5px; padding-right: 5px" scope="rowgroup" valign="middle" | Not stated<br/> | | style="text-align: center; padding-left: 5px; padding-right: 5px" scope="rowgroup" valign="middle" | Not stated<br/> | ||

|} | |} | ||

</div> | </div><header><hgroup> | ||

== Dominant Relations: Infrastructure == | |||

</hgroup></header> | |||

The dominant relations in the Infrastructure model are those that determine the expected levels of infrastructure stocks and access, spending on infrastructure, and the impacts of infrastructure on health and productivity. The expected levels of infrastructure stocks and access are influenced by socio-economic factors related to population, economic activity, governance, and educational attainment. In almost every case there are also path dependencies that supplement the basic relationships, reflecting the considerable inertia in infrastructure development. | |||

Spending on infrastructure is divided into private and public spending, with the latter further divided into ‘core’ and ‘other’ infrastructure. ‘Core’ infrastructure refers to those types of infrastructure that are explicitly represented in the model; ‘other’ infrastructure refers to those types of infrastructure that are not explicitly represented in the model (see [http://www.du.edu/ifs/help/understand/infrastructure/system.html Infrastructure Types]). Public spending on core infrastructure, GDS(Infra), is driven by the required spending to meet the expected levels of infrastructure (INFRABUDDEMMNT and INFRABUDDEMNEW), total government consumption (GOVCON), and the demands on government consumption from other categories. Public spending on other infrastructure, GDS(InfraOther), is driven by average GDP per capita (GDPPCP), total government consumption (GOVCON), and the demands on government consumption from other categories. Deficits and surpluses of government funds will affect the actual levels of funds allocated for both core and other infrastructure. The public spending on core infrastructure leverages a certain amount of private spending on core infrastructure, with the amount leveraged depending upon historical relationships found in the literature, which nominally reflect the variation in public and private returns between particular types of infrastructure. Finally, in recognition of the incremental approaches that public budgeting decisions usually follow, our model avoids unusually sharp increases in public spending on infrastructure by smoothing it out over time. | |||

Infrastructure development directly affects multifactor productivity, with this effect being treated separately for non-ICT and ICT related infrastructure. The use of solid fuels in the home and access to improved water and sanitation directly affect human health through their effects on the mortality and morbidity rates of specific diseases—diarrheal diseases, acute respiratory infections, and respiratory diseases. | |||

For detailed discussion of the model's causal dynamics, see the discussions of [http://www.du.edu/ifs/help/understand/infrastructure/flowcharts/index.html flow charts] (block diagrams) and [http://www.du.edu/ifs/help/understand/infrastructure/equations/index.html equations]. | |||

<header><hgroup> | |||

== Initializing the Infrastructure Data == | |||

</hgroup></header> | |||

The IFs preprocessor uses historical data to prepare data for the base year of the model, currently 2010. We describe the general workings of the IFs preprocessor [http://www.ifs.du.edu/assets/documents/preprocessorv1_0.pdf here]. However, there are some peculiarities in the infrastructure model, specifically related to the initialization of the variables related to spending on infrastructure. | |||

Because of the paucity and inconsistency of the historical data on infrastructure spending discussed above, IFs does not use actual historical data on spending, but rather estimates spending in the first year of the model based upon data on the stocks of and access to infrastructure after the pre-processor has filled any gaps in the historical data. The procedure is as follows: | |||

*We assume that: 1) the amount of infrastructure requiring maintenance in the base year is given by the level of infrastructure in the previous year (2009) times a factor based on the lifetime of the infrastructure (see table 5 below), and 2) the amount of newly constructed infrastructure is the difference between the amount of infrastructure in the base year (2010) and the previous year (2009). | |||

*Total spending on maintenance, ''INFRAINVESTMAINT'', is estimated as the amount of infrastructure requiring maintenance times the unit cost for each type of infrastructure (see Table 6 below). | |||

*Total spending on new construction, ''INFRAINVESTNEW'', is estimated as the amount of new construction times the unit cost for each type of infrastructure. If the amount of newly constructed infrastructure is less than or equal to zero, spending on that type of infrastructure is set to zero. | |||

*For each type of infrastructure, public spending on maintenance, ''INFRAINVESTMAINTPUB'', and new construction, ''INFRAINVESTNEWPUB'', are estimated by multiplying the total spending by infrastructure specific parameters, '''''infrainvmaintpubshrm'' ''' and '''''infrainvnewpubshrm'' ''', indicating the share of total spending that is assumed to be public. | |||

*The sum of estimated public spending on maintenance and new construction, across all types of core infrastructure, provides an initial estimate of government consumption for core infrastructure, ''GDS(Infrastructure)''. | |||

*If, in the first year budgeting process, total estimated government consumption on core infrastructure is reduced, an infrastructure cost adjustment factor, ''INFRACOSTADJFAC'', is calculated as the ratio of the final to the initial value of ''GDS(Infrastructure)''. The value of ''INFRACOSTADJFAC'' is also used to adjust infrastructure spending in future years. It gradually converges to 1 over the time period given by the parameter '''''infracostadjfacconvtime'' '''. | |||

*The initial estimates of ''INFRAINVESTMAINT'', ''INFRAINVESTNEW'', ''INFRAINVESTMAINTPUB'', and ''INFRAINVESTNEWPUB'' are each multiplied by ''INFRACOSTADJFAC'' to calculate their final values. | |||

*The initial value of public spending on other infrastructure, ''GDS(InfraOther'' ''')''', is calculated as a function of average income, ''GDPPCP'', multiplied by ''INFRACOSTADJFAC''. This function is: | |||

http://www.du.edu/ifs/help/media/images/infraeqa1.PNG | |||

GDS(InfraOther) = government spending on other infrastructure in billion constant 2005 dollars | |||

GDP = gross domestic product at market exchange rates in billion constant 2005 dollars | |||

GDPPCP = gross domestic product per capita at purchasing power parity in thousand constant 2005 dollars | |||

<header><hgroup> | |||

== Infrastructure Flow Charts == | |||

</hgroup></header> | |||

=== Overview === | |||

The introduction provided an overview of the infrastructure model within IFs, noting that this involves moving through the following sequence for each forecast year. This section describes each of these five steps: | |||

<header><hgroup> | |||

== Estimating the Expected Levels of Infrastructure == | |||

</hgroup></header> | |||

At the core of our forecasts of the expected levels of infrastructure is a set of estimated equations embedded within a set of accounting relationships. The equations are presented [http://www.du.edu/ifs/help/understand/infrastructure/equations/index.html here]. | |||

Additional elements beyond the estimated equations are involved in specifying the expected values of infrastructure, and we handle some of these elements algorithmically. For instance, the base year calculated estimations will most often not match exactly the historical data for countries in the base year.<sup>[1]</sup> Each country has peculiarities that differentiate it from the “typical pattern”; among the factors not captured by our equations for estimating the base year country values are many aspects of geography, culture, and unique historical development paths. And sometimes, of course, data errors account for such differences. | |||

To deal with this issue of differences between our estimated values and reported data in the base year, the model calculates an additive or a multiplicative country and variable specific shift factor representing that difference; we allow those shift factors to gradually diminish over time, thereby causing countries to approach the expected value function. Among the reasons for allowing convergence is that we quite consistently see that the patterns of higher-income countries are more similar and more like those of our general equations than are those of lower-income countries. On the assumption that countries will seldom abandon infrastructure they have already developed, however, our downward convergence is extremely slow relative to our upward convergence. | |||

A second instance in which we make adjustments to our core estimated equations is when the dynamic trajectory of demand/supply growth in a country in recent years is inconsistent with the forecasts produced by the equations. For instance, a policy-based surge of infrastructure development like that seen recently in China may result in a historical growth rate well above the one that our functions produce in the first years of our forecasting. Making a simplifying assumption that these growth rates will change only gradually, we estimate the growth rate of physical infrastructure stock using the historical data over three to five recent years and incorporate that growth rate in the demand estimation through a moving average-based extrapolative formulation. | |||

We make a final adjustment in those cases where we wish to modify the estimates of expected infrastructure for scenario analysis. This can be accomplished in several ways. First, most of the estimates can be adjusted with the use of a simple multiplier. Second, we can stipulate specific levels for specific types of infrastructure in a specific future year; in this case, the model will automatically forecast a linear approach to the targeted level from the base year. Third, we can modify both the rates at which the country shift factors converge and the levels, in relation to the expected values, to which the shift factors converge. For example, we can drive the shift factors to those of the best performing countries, i.e., those that perform better than expected, by a certain date. This will, in turn, affect the levels to which the physical infrastructures themselves converge (see [http://www.du.edu/ifs/help/understand/equations/specialized/setargeting.html Standard Error Targeting]). | |||

=== Transportation === | |||

The primary indicators of transportation infrastructure included in IFs are: 1) the total road density in kilometers per 1000 hectares, ''INFRAROAD'', 2) the percentage of roads that are paved, ''INFRAROADPAVEDPCNT'', and 3) the Rural Access Index, ''INFRAROADRAI'', the percentage of the rural population living within two kilometers of an all-season road. From these, we can calculate additional indicators, such as the expected lengths of paved and unpaved roads. | |||

The general sequence of calculations for estimating the expected values of these variables is shown in the figure below. We begin by estimating road density (''INFRAROAD'') as a function of income density, population density, and land area. The percentage of roads that are paved (''INFRAROADPAVEDPCNT'') is then calculated as a function of the estimated road density, GDP per capita (''GDPPCP''), population (''POP''), and land area (''LANDAREA''). In parallel, the Rural Access Index(''INFRAROADRAI'') is calculated as a function of the estimated road density (kilometers per person) and income density (dollars per hectare). | |||

| |||

Revision as of 18:35, 28 January 2017

Infrastructure

The most recent and complete infrastructure model documentation is available on Pardee's website. Although the text in this interactive system is, for some IFs models, often significantly out of date, you may still find the basic description useful to you.

The current version of the infrastructure model within IFs was developed in concert with the production of Building Global Infrastructure, the fourth volume in the Patterns of Potential Human Progress series (Rothman et al 2013). Further details on the model and analyses can be found in that volume.

Overview

The purpose of the infrastructure model is to forecast the following:

- the amount of particular forms of infrastructure;

- the level of access to these particular forms of infrastructure;

- the level of spending on infrastructure; and

- the effect of infrastructure development on other socio-economic and environmental systems

The infrastructure model includes parameters that allow users to explore a range of alternative scenarios around infrastructure. These can be used to ask questions such as:

- What would be the costs and benefits if countries were to accelerate infrastructure development above that seen in the Base Case?

- What if the unit costs of infrastructure development or infrastructure lifetimes were to differ from the assumptions used in the Base Case?

- What if the impacts of infrastructure development on economic productivity and health were to differ from the assumptions used in the Base Case?

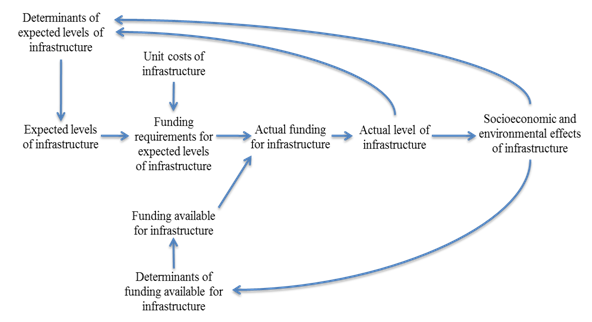

Unlike many previous studies, which estimate only the demand for infrastructure, IFs forecasts a path jointly determined by both the demand for infrastructure and the funding available to meet that demand. Therefore, the amount of infrastructure forecasted in IFs in each year explicitly accounts for expected fiscal constraints. Furthermore, the socio-economic and environmental effects of infrastructure feed forward to the drivers of infrastructure demand and supply in future years.

The figure below provides an overview of the infrastructure model within IFs. In brief, the infrastructure modeling in IFs involves moving through the following sequence for each forecast year:

- Estimating the expected levels of infrastructure

- Translating the expected levels of infrastructure into financial requirements

- Balancing the financial requirements with available resources

- Forecasting the actual levels of attained infrastructure

- Estimating the social, economic, and environmental impacts of the attained infrastructure

Each of these steps are described in more detail below.

For more on the infrastructure module, see the links below

Structure and Agent System: Infrastructure

System/Subsystem

|

Infrastructure

|

Organizing Structure

|

|

Stocks

|

Physical infrastructure, Access rates

|

Flows

|

Spending (public and private on ‘core’ infrastructure; public on ‘other’ infrastructure)

|

Key Aggregate Relationships (illustrative, not comprehensive)

|

Demand for physical infrastructure and access changes with population, income, and other societal changes More infrastructure helps economic growth and reduces health effects from specific diseases Public spending available for infrastructure rises with income level Public spending leverages private spending Lack (surplus) of public spending on ‘core’ infrastructure hurts (helps) infrastructure development

|

Key Agent-Class Behavior Relationships (illustrative, not comprehensive)

|

Government revenue and expenditure on infrastructure |

Infrastructure Types

IFs distinguishes between ‘core’ and ‘other’ infrastructure. Core infrastructure refers to those types of infrastructure that we represent explicitly in IFs—roads, electricity generation, improved water and sanitation, and ICT. Other infrastructure refers to those types that we do not represent explicitly—e.g., railroads, ports, airports, and types of infrastructure yet to be envisioned. The choice of what to include as core infrastructure reflects the availability of historical data and understanding of what can be modelled.

Infrastructure Access and Stocks

The table below summarizes the primary variables in IFs related to infrastructure stocks and access. From these and other variables forecasted by IFs, we are able to calculate numerous other indicators—for example, the number of persons with access to electricity.

| Variable Name in IFs (dimensions) | Description | Units | |

| Access | INFRAROADRAI* | Access to rural roads | percentage of rural population living within 2 kilometers of an all-season road |

| INFRAELECACC* (rural, urban, total) | Access to electricity | percentage of population with access | |

| ENSOLFUEL | Solid fuel use | percentage of population using solid fuels as their main household energy source | |

| WATSAFE* (none, other improved, piped) | Access to improved water | percentage of population with access by type | |

| SANITATION* (other unimproved, shared, improved) | Access to improved sanitation | percentage of population with access by type | |

| WATWASTE | Access to wastewater collection connection | percentage of population with wastewater collection | |

| WATWASTETREAT* | Access to wastewater treatment | percentage of population with wastewater treatment | |

| INFRATELE* | Fixed telephone lines | lines per 100 persons | |

| ICTBROAD* | Fixed broadband subscriptions | subscriptions per 100 persons | |

| ICTMOBIL* | Mobile telephone subscriptions | subscriptions per 100 persons | |

| ICTBROADMOBIL* | Mobile broadband subscriptions | subscriptions per 100 persons | |

| Physical Stocks | INFRAROAD* | Total road density | kilometers per 1000 hectares |

| INFRAROADPAVEDPCNT* | Percentage of roads paved | percentage | |

| INFRAELECGENCAP* | Electricity generation capacity per capita | kilowatts per person | |

| LANDIRAREAEQUIP | Area equipped with irrigation | 1000 hectares | |

| *Note: Each of these variables has a companion variable with the extension DEM; for example, the variable INFRAROADRAI has a companion variable named INFRAROADRAIDEM. These companion variables indicate the amount of the infrastructure stock or access that would be expected to exist in the absence of financial constraints. | |||

Infrastructure Spending

The following table summarizes the primary variables in IFs related to infrastructure spending. As with the access and stock variables, from these and other variables forecasted in IFs, we are able to calculate numerous other indicators—for example, the ratio of total public to private spending on infrastructure. Please note that although we do not represent these other forms of infrastructure explicitly, we do estimate spending on them in order to avoid almost certainly underrepresenting the total demand for infrastructure. This is given by the variable GDS(InfraOther).

| Variable Name in IFs | Description | Units |

| GDS (infrastructure, infraother) | Government consumption, by category[1] | billion dollars |

| INFRAINVESTMAINT | Total (public plus private) investment for infrastructure maintenance, by type of infrastructure[2] | billion dollars |

| INFRAINVESTMAINTPUB[3] |

Public investment for infrastructure maintenance, by type of infrastructure[2] | billion dollars |

| INFRAINVESTNEW | Total (public plus private) investment for construction of new infrastructure, by type of infrastructure[2] | billion dollars |

| INFRAINVESTNEWPUB[3] | Public investment for construction of new infrastructure, by type of infrastructure[2] | billion dollars |

|

[1] The categories are military, health, education, R&D, Infrastructure, InfraOther, Other, and Total. [2] The types of infrastructure included are RoadPaved, RoadUnPaved, ElectricityGen, ElectricityAccRural, ElectricityAccUrban, Irrigation, SafeWaterHH, SafeWaterImproved, SanitationHH, SanitationImproved, WasteWater, Telephone, Mobile, Broadband, BroadbandMobile, and Total. Currently, no cost is assumed for access to Unimproved water, Other unimproved sanitation, solid fuel use, or a wastewater collection connection. [3] Each of these variables has a companion variable, which indicates the amount of public investment that is desired based upon the expected levels of infrastructure. For INFRAINVESTMAINTPUB, the companion variable is named INFRABUDDEMMNT and for INFRAINVESTNEWPUB, the companion variable is named INFRABUDDEMNEW. The differences between the desired and actual amounts of public investment result from the budgeting process described below. | ||

Forward Links from Infrastructure

Although there are a wide range of potential social, economic, and environmental impacts of infrastructure, we limit our modeling of the direct effects of infrastructure to its effects on economic productivity and a small set of health impacts. Currently, the empirical research on these effects are more advanced—and the effects themselves more amenable to modeling—than the direct effects of infrastructure on factors such as income inequality, educational attainment, or governance. To the extent direct effects and other aspects, such as spending on infrastructure that reduces spending on other categories, affect other systems included in IFs, infrastructure will have a number of indirect effects.

Sources of Infrastructure Data

Infrastructure Stocks and Access

In terms of historical data on infrastructure stocks and access, we can turn to various international organizations with specific emphases. These include the International Road Federation (IRF) for transportation, the International Energy Agency (IEA) for energy, and the International Telecommunication Union (ITU) for telecommunications. No one organization focuses on water and sanitation systems, but a number of different organizations, such as the Joint Monitoring Programme (JMP) of WHO and the United Nations Children’s Fund (UNICEF), the United Nations Statistics Division, and the United Nations Food and Agriculture Organization (FAO), maintain global data related to certain aspects of water infrastructure. The table below summarizes a number of the datasets these groups maintain.

| Infrastructure Type | Organization | Spatial Coverage | Temporal Coverage | Infrastructure Coverage |

| Transportation | International Road Federation | Global | Annual data: 1968–2009 | Total road network length, percent of road network paved, and road density |

| World Bank | Global | Data for most recent year only | Percentage of rural population with access to an all-season road | |

| Electricity and Energy | United States Energy Information Administration | Global | Annual data: 1980–2010 | Total installed electricity generation capacity and generation capacity by energy type |

| International Energy Agency | Global | Annual data: 1960–2009 | Electricity production by source type; total electricity production; percent of total, urban, and rural population with access to electricity | |

| Water and Sanitation | WHO and UNICEF Joint Monitoring Programme for Water Supply and Sanitation | Global | Annual data: 1990−2010 | Percent of population with access to improved, piped, other improved, and unimproved water, and to sanitation facilities |

| Food and Agriculture Organization AQUASTAT database | Global | Annual data: 1960–2010 | Percent of arable land equipped for irrigation and water use/withdrawals by sector | |

| United Nations Statistics Division | Global | Data for most recent year available only | Percent of population with wastewater connection and percent with connection to wastewater treatment | |

| Information and Communication Technologies | International Telecommunication Union | Global | Annual data: 1960–2011 | Number of telephone mainlines, cell phone subscriptions, broadband subscriptions, mobile broadband subscriptions, and number of computer/internet users |

In addition to these primary data sources, the World Bank’s World Development Indicators (WDI) and the World Resources Institute’s Earth Trends databases act as clearinghouses for much of the same data. We can turn also to Canning (1998), Canning and Farahani (2007), and Estache and Goicoechea (2005),who have drawn on these and other sources in attempts to create global databases of infrastructure stocks and access, increase the number of years covered for certain time-series while maintaining consistent definitions, and correct errors. Further, as part of the Africa Infrastructure Country Diagnostic (AICD), the World Bank and the African Development Bank developed an extensive database on infrastructure in Africa. Finally, G. Hughes, Chinowsky, and Strzepek (2009) and Calderón and Servén (2010a; 2010b), among others, have used and modified a number of these databases in their own studies.

Infrastructure Spending

There exist relative little organized historical data on infrastructure spending. In considering public investment in infrastructure (PII), some researchers have used other measures in the Systems of National Accounts, usually fixed capital formation or government outlays by economic sector, as proxies (Agénor, Nabli, and Yousef 2007; Cavallo and Daude 2008; Organisation for Economic Co-operation and Development 2009a; Ter-Minassian and Allen 2004). Lora (2007: 7), however, strongly argued against this practice

because capital expenditures by the central or the consolidated government as measured by the International Monetary Fund’s Government Financial Statistics . . . are a very poor measure of actual PII, which in many countries is mostly undertaken by state-owned enterprises or local governments whose operations are not well captured by this source.

Estache (2010: 67) adds:

Neither the national accounts nor the IMF [International Monetary Fund] Government Finance Statistics (GFS) report a disaggregation of total and public investment data detailed enough to allow identifying every infrastructure sub-sector. In national accounts, energy data cover both electricity and gas but also all primary-energy related products such as petroleum. Similarly, the data do not really distinguish between transport and communication. Water expenditures can be hidden in public works or even in health expenditures.

The World Bank does collect data on private investment in infrastructure in its Private Participation in Infrastructure Project Database. Unfortunately, limitations to this database make us hesitant to rely on it as a primary source of data on infrastructure investment. First, it provides data only on projects in low and middle-income countries in which there is private participation. Second, the amounts in the database primarily reflect commitments, not actual investments. Third, it relies exclusively on information that is made publicly available. Finally, the Bank itself states that it “should not be seen as a fully comprehensive resource.”

This leaves us needing to rely on national, regional, and global studies and reports that provide estimates of infrastructure spending. Given their varied purposes, these studies and reports tend to differ in a number of significant dimensions: temporal coverage; types of infrastructure included; sources of funding (e.g., public versus private); and purpose of expenditure (e.g., new construction versus maintenance). Therefore, we need to be careful in comparing data across studies and in drawing conclusions from them. Even so, they provide a starting point for our exploration. The following table lists a number of these studies and summarizes some of the major elements in their approaches.

| Study | Spatial Coverage | Temporal Coverage | Infrastructure Coverage | Source of Funds | Purpose of Expenditure |

| Trends in Transport Infrastructure Investment 1995–2009 (International Transport Forum and Organisation for Economic Co-operation and Development 2011) | Albania, Australia, Austria, Azerbaijan, Belgium, Bosnia, Bulgaria, Canada, Croatia, Czech Republic, Denmark, Estonia, Finland, , France, Georgia, Germany, Greece, Hungary, Iceland, India, Ireland, Italy, Japan, Korea, Latvia, Liechtenstein, Lithuania, Luxembourg, Macedonia, Malta, Mexico, Moldova, Montenegro, Netherlands, New Zealand, Norway, Poland, Portugal, Romania, Russia, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, United Kingdom, United States | Annual data: 1992–2009 | Separate data for rail, road, inland waterways, maritime ports, and airports | Combined public and private sources for investment; only spending by public authorities for maintenance | Separate data for investment and maintenance |

| Africa Infrastructure Country Diagnostic (http://www.-infrastructureafrica.-org/aicd/tools/data) | Benin, Botswana, Burkina Faso, Cameroon, Cape Verde, Chad, Congo, Côte d’Ivoire, Democratic Republic of the Congo, Ethiopia, Ghana, Kenya, Lesotho, Madagascar, Malawi, Mozambique, Namibia, Nigeria, Rwanda, Senegal, South Africa, Tanzania, Uganda, Zambia | Annual average for one period: 2001–2006 | Separate data for electricity, ICT, irrigation, transportation, and water supply and sanitation | Public and private | Separate data for new construction and for operation and maintenance |

| Infrastructure in Latin America (Calderón and Servén 2010b) | Argentina, Brazil, Chile, Colombia, Mexico, Peru | Annual data: 1980–2006 | Separate data for telecommunications, power generation, land transportation (roads and railways), and water and sanitation | Separate data for public and private | Total spending (construction, operations, and maintenance) |

| Public Spending on Transportation and Water Infrastructure (Congressional Budget Office 2010) | United States | Annual data: 1956–2007 | Separate data for highways, mass transit, rail, aviation, water transportation, water resources, and water supply and wastewater treatment | Public only, broken down by (1) federal, and (2) state and local | Separate data for capital expenditures and for operation and maintenance |

| Infrastructure Development in India and China—A Comparative Analysis (Kim and Nangia 2010) | China, India | Annual data: 1985–2006 | Combined data for electricity, water, gas, transport, and communications | Combined public and private | Not stated |

| Going for Growth: Economic Policy Reforms (Organisation for Economic Co-operation and Development 2009a) | Australia, Austria, Belgium, Canada, Finland, France, Iceland, Ireland, Italy, Netherlands, New Zealand, Norway, South Korea, Spain, Sweden, United Kingdom, United States | Annual averages for four periods: 1970–1979, 1980–1989, 1990–1999, 2000–2006 | Aggregate data provided separately for (1) electricity, gas, and water, and (2) transport and communications | Combined public and private | Aggregate investment (from national accounts) |

| Connecting East Asia: A New Framework for Infrastructure (Asian Development Bank, Japan Bank for International Cooperation, and World Bank 2005) |

Cambodia, China, Indonesia, Laos, Mongolia, Philippines, Thailand, Vietnam |

Annual data for select years: 1998, 2003 | Separate data for transportation, telecommunications, water and sanitation, other urban infrastructure, and power | Separate data for national government, local government, state owned enterprises, and private | Not stated |

<header><hgroup>

Dominant Relations: Infrastructure

</hgroup></header> The dominant relations in the Infrastructure model are those that determine the expected levels of infrastructure stocks and access, spending on infrastructure, and the impacts of infrastructure on health and productivity. The expected levels of infrastructure stocks and access are influenced by socio-economic factors related to population, economic activity, governance, and educational attainment. In almost every case there are also path dependencies that supplement the basic relationships, reflecting the considerable inertia in infrastructure development.

Spending on infrastructure is divided into private and public spending, with the latter further divided into ‘core’ and ‘other’ infrastructure. ‘Core’ infrastructure refers to those types of infrastructure that are explicitly represented in the model; ‘other’ infrastructure refers to those types of infrastructure that are not explicitly represented in the model (see Infrastructure Types). Public spending on core infrastructure, GDS(Infra), is driven by the required spending to meet the expected levels of infrastructure (INFRABUDDEMMNT and INFRABUDDEMNEW), total government consumption (GOVCON), and the demands on government consumption from other categories. Public spending on other infrastructure, GDS(InfraOther), is driven by average GDP per capita (GDPPCP), total government consumption (GOVCON), and the demands on government consumption from other categories. Deficits and surpluses of government funds will affect the actual levels of funds allocated for both core and other infrastructure. The public spending on core infrastructure leverages a certain amount of private spending on core infrastructure, with the amount leveraged depending upon historical relationships found in the literature, which nominally reflect the variation in public and private returns between particular types of infrastructure. Finally, in recognition of the incremental approaches that public budgeting decisions usually follow, our model avoids unusually sharp increases in public spending on infrastructure by smoothing it out over time.

Infrastructure development directly affects multifactor productivity, with this effect being treated separately for non-ICT and ICT related infrastructure. The use of solid fuels in the home and access to improved water and sanitation directly affect human health through their effects on the mortality and morbidity rates of specific diseases—diarrheal diseases, acute respiratory infections, and respiratory diseases.

For detailed discussion of the model's causal dynamics, see the discussions of flow charts (block diagrams) and equations. <header><hgroup>

Initializing the Infrastructure Data

</hgroup></header> The IFs preprocessor uses historical data to prepare data for the base year of the model, currently 2010. We describe the general workings of the IFs preprocessor here. However, there are some peculiarities in the infrastructure model, specifically related to the initialization of the variables related to spending on infrastructure.

Because of the paucity and inconsistency of the historical data on infrastructure spending discussed above, IFs does not use actual historical data on spending, but rather estimates spending in the first year of the model based upon data on the stocks of and access to infrastructure after the pre-processor has filled any gaps in the historical data. The procedure is as follows:

- We assume that: 1) the amount of infrastructure requiring maintenance in the base year is given by the level of infrastructure in the previous year (2009) times a factor based on the lifetime of the infrastructure (see table 5 below), and 2) the amount of newly constructed infrastructure is the difference between the amount of infrastructure in the base year (2010) and the previous year (2009).

- Total spending on maintenance, INFRAINVESTMAINT, is estimated as the amount of infrastructure requiring maintenance times the unit cost for each type of infrastructure (see Table 6 below).

- Total spending on new construction, INFRAINVESTNEW, is estimated as the amount of new construction times the unit cost for each type of infrastructure. If the amount of newly constructed infrastructure is less than or equal to zero, spending on that type of infrastructure is set to zero.

- For each type of infrastructure, public spending on maintenance, INFRAINVESTMAINTPUB, and new construction, INFRAINVESTNEWPUB, are estimated by multiplying the total spending by infrastructure specific parameters, infrainvmaintpubshrm and infrainvnewpubshrm , indicating the share of total spending that is assumed to be public.

- The sum of estimated public spending on maintenance and new construction, across all types of core infrastructure, provides an initial estimate of government consumption for core infrastructure, GDS(Infrastructure).

- If, in the first year budgeting process, total estimated government consumption on core infrastructure is reduced, an infrastructure cost adjustment factor, INFRACOSTADJFAC, is calculated as the ratio of the final to the initial value of GDS(Infrastructure). The value of INFRACOSTADJFAC is also used to adjust infrastructure spending in future years. It gradually converges to 1 over the time period given by the parameter infracostadjfacconvtime .

- The initial estimates of INFRAINVESTMAINT, INFRAINVESTNEW, INFRAINVESTMAINTPUB, and INFRAINVESTNEWPUB are each multiplied by INFRACOSTADJFAC to calculate their final values.

- The initial value of public spending on other infrastructure, GDS(InfraOther ), is calculated as a function of average income, GDPPCP, multiplied by INFRACOSTADJFAC. This function is:

http://www.du.edu/ifs/help/media/images/infraeqa1.PNG

GDS(InfraOther) = government spending on other infrastructure in billion constant 2005 dollars

GDP = gross domestic product at market exchange rates in billion constant 2005 dollars

GDPPCP = gross domestic product per capita at purchasing power parity in thousand constant 2005 dollars <header><hgroup>

Infrastructure Flow Charts

</hgroup></header>

Overview

The introduction provided an overview of the infrastructure model within IFs, noting that this involves moving through the following sequence for each forecast year. This section describes each of these five steps: <header><hgroup>

Estimating the Expected Levels of Infrastructure

</hgroup></header> At the core of our forecasts of the expected levels of infrastructure is a set of estimated equations embedded within a set of accounting relationships. The equations are presented here.

Additional elements beyond the estimated equations are involved in specifying the expected values of infrastructure, and we handle some of these elements algorithmically. For instance, the base year calculated estimations will most often not match exactly the historical data for countries in the base year.[1] Each country has peculiarities that differentiate it from the “typical pattern”; among the factors not captured by our equations for estimating the base year country values are many aspects of geography, culture, and unique historical development paths. And sometimes, of course, data errors account for such differences.

To deal with this issue of differences between our estimated values and reported data in the base year, the model calculates an additive or a multiplicative country and variable specific shift factor representing that difference; we allow those shift factors to gradually diminish over time, thereby causing countries to approach the expected value function. Among the reasons for allowing convergence is that we quite consistently see that the patterns of higher-income countries are more similar and more like those of our general equations than are those of lower-income countries. On the assumption that countries will seldom abandon infrastructure they have already developed, however, our downward convergence is extremely slow relative to our upward convergence.

A second instance in which we make adjustments to our core estimated equations is when the dynamic trajectory of demand/supply growth in a country in recent years is inconsistent with the forecasts produced by the equations. For instance, a policy-based surge of infrastructure development like that seen recently in China may result in a historical growth rate well above the one that our functions produce in the first years of our forecasting. Making a simplifying assumption that these growth rates will change only gradually, we estimate the growth rate of physical infrastructure stock using the historical data over three to five recent years and incorporate that growth rate in the demand estimation through a moving average-based extrapolative formulation.

We make a final adjustment in those cases where we wish to modify the estimates of expected infrastructure for scenario analysis. This can be accomplished in several ways. First, most of the estimates can be adjusted with the use of a simple multiplier. Second, we can stipulate specific levels for specific types of infrastructure in a specific future year; in this case, the model will automatically forecast a linear approach to the targeted level from the base year. Third, we can modify both the rates at which the country shift factors converge and the levels, in relation to the expected values, to which the shift factors converge. For example, we can drive the shift factors to those of the best performing countries, i.e., those that perform better than expected, by a certain date. This will, in turn, affect the levels to which the physical infrastructures themselves converge (see Standard Error Targeting).

Transportation

The primary indicators of transportation infrastructure included in IFs are: 1) the total road density in kilometers per 1000 hectares, INFRAROAD, 2) the percentage of roads that are paved, INFRAROADPAVEDPCNT, and 3) the Rural Access Index, INFRAROADRAI, the percentage of the rural population living within two kilometers of an all-season road. From these, we can calculate additional indicators, such as the expected lengths of paved and unpaved roads.

The general sequence of calculations for estimating the expected values of these variables is shown in the figure below. We begin by estimating road density (INFRAROAD) as a function of income density, population density, and land area. The percentage of roads that are paved (INFRAROADPAVEDPCNT) is then calculated as a function of the estimated road density, GDP per capita (GDPPCP), population (POP), and land area (LANDAREA). In parallel, the Rural Access Index(INFRAROADRAI) is calculated as a function of the estimated road density (kilometers per person) and income density (dollars per hectare).